On-demand insurance is revolutionizing the industry, offering a flexible and convenient alternative to traditional policies. Imagine insurance tailored to your specific needs, accessible instantly, and often at a lower cost. This new model is addressing the pain points of traditional insurance while harnessing the power of technology to create a more efficient and customer-centric experience.

This new approach allows for greater customization and immediate coverage, perfect for a rapidly evolving world. By examining the market trends, technological advancements, and customer experience, we can better understand how on-demand insurance is reshaping the insurance landscape and what the future holds.

Defining On-Demand Insurance

On-demand insurance is a rapidly evolving approach to insurance that offers greater flexibility and customization compared to traditional models. It leverages technology to provide coverage on an as-needed basis, responding to specific events or circumstances rather than requiring continuous, fixed premiums. This shift is driven by the desire for more agile and affordable insurance solutions.This innovative model differs significantly from traditional insurance, which typically requires upfront commitments and fixed premiums for a set period.

On-demand insurance allows consumers to pay only for the coverage they need, making it particularly attractive for infrequent or unpredictable events.

Key Characteristics of On-Demand Insurance

On-demand insurance is characterized by its dynamic and flexible nature. It typically involves short-term policies triggered by specific events or needs. The pricing and coverage are often determined in real-time, adjusting to the specifics of each transaction. This adaptability is a core difference from traditional insurance policies, which offer pre-defined coverage for a fixed duration.

On-demand insurance is becoming increasingly popular, making it easier to get coverage when you need it. This is often linked to the rise of e-wallets, like E-wallet , which simplify payment processes. Using e-wallets for premium payments makes on-demand insurance even more convenient, streamlining the whole process.

Differences from Traditional Insurance

Traditional insurance products, such as auto, homeowners, and health insurance, are designed for continuous coverage. They require a sustained premium payment and offer pre-defined benefits. On-demand insurance, conversely, focuses on providing coverage when needed, responding to specific events. The key difference lies in the immediacy and responsiveness of the coverage, making it suitable for scenarios where traditional coverage might be too broad or expensive.

Types of On-Demand Insurance

Several types of on-demand insurance products are emerging in the market. These include:

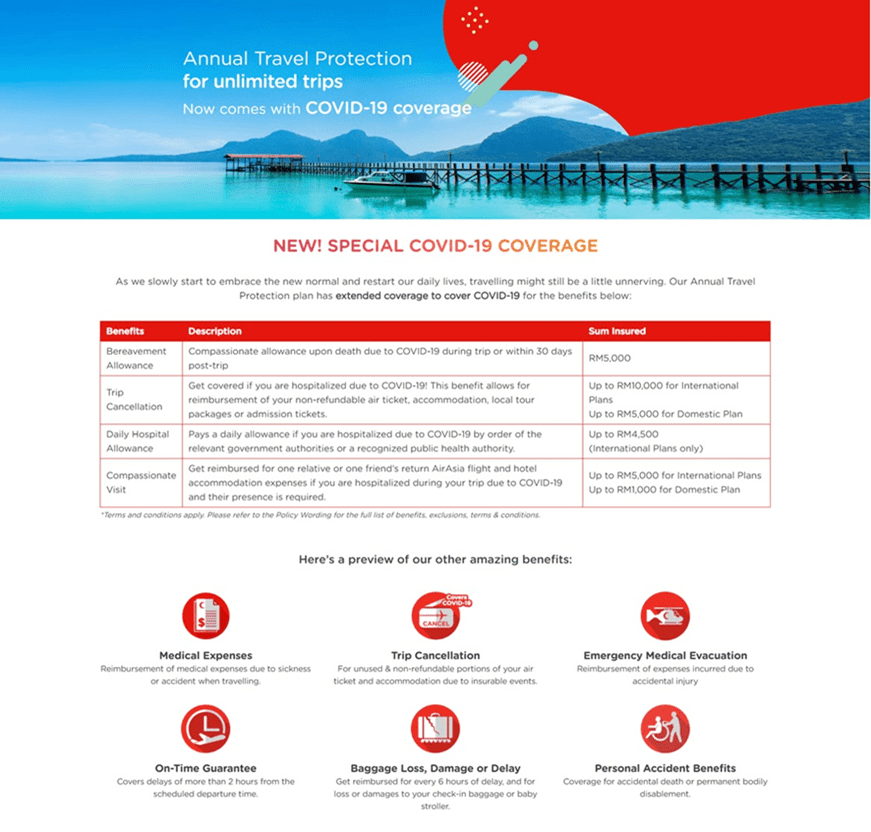

- Trip insurance: This type of insurance provides coverage for specific travel events, such as flight cancellations or delays, lost luggage, or medical emergencies. It’s highly valuable for individuals or groups traveling internationally or within the country.

- Event insurance: Designed for specific events, such as concerts, festivals, or sporting events. This type of insurance can cover damage to personal property, injuries, or lost belongings at the event.

- Pet insurance: Coverage for pet-related emergencies, such as accidents or illnesses, can be triggered by a veterinarian visit. It allows pet owners to get prompt care when needed without the need for a full policy.

- Temporary rental insurance: This coverage is designed for situations where temporary rentals of property or equipment are involved. For example, if a renter damages rented equipment, this insurance can cover the repairs.

Real-World Applications

On-demand insurance is finding applications in various sectors. For example, businesses can use it to cover temporary equipment breakdowns, or individuals can use it for specific events like a trip or a home renovation. Its flexible nature makes it adaptable to a wide range of situations.

Comparison Table

| Feature | On-Demand Insurance | Traditional Insurance |

|---|---|---|

| Coverage Trigger | Specific event or need | Fixed period/duration |

| Premium Payment | Pay-per-event or as-needed | Regular, fixed payments |

| Flexibility | Highly flexible and adaptable | Less flexible, pre-defined coverage |

| Coverage Duration | Limited to the event or need | Extended period |

| Cost | Potentially lower for infrequent events | Potentially higher for infrequent events |

Market Trends and Growth

On-demand insurance is rapidly gaining traction, promising a more flexible and tailored approach to insurance. This innovative model is poised to reshape the traditional insurance industry, catering to the evolving needs of modern consumers.The current market size of on-demand insurance is still relatively small compared to traditional insurance, but projected growth is significant. This is driven by factors such as increased digital adoption, the desire for greater control over insurance purchases, and a growing recognition of the potential for customized coverage.

Furthermore, the rise of gig economy workers and the need for adaptable insurance solutions are fueling the demand.

Current Market Size and Projected Growth

The exact market size of on-demand insurance is difficult to pinpoint due to the nascent nature of the market and varying definitions of “on-demand.” However, industry analysts project substantial growth in the coming years. Estimates suggest that the market will see a compound annual growth rate (CAGR) of 15-20% over the next five years, fueled by the increasing popularity of subscription-based models and the rising adoption of digital insurance platforms.

For example, the surge in ride-sharing and delivery services has created a demand for on-demand insurance to protect drivers and businesses operating in these sectors.

Key Factors Driving Growth

Several key factors are propelling the growth of on-demand insurance. These include:

- Increased digital adoption: Consumers are increasingly comfortable with online transactions and digital services, making on-demand insurance more appealing.

- Desire for greater control: Consumers want more control over their insurance purchases, including choosing the coverage they need and the frequency of payments.

- Customization and tailored coverage: On-demand insurance allows for greater customization and tailoring of coverage to individual needs, making it more appealing compared to traditional, one-size-fits-all policies.

- Adaptability to changing needs: On-demand insurance offers greater flexibility and adaptability, particularly for those in the gig economy or those with fluctuating income and work schedules.

- Lower administrative costs: Digital platforms and automated processes often lead to lower administrative costs for on-demand insurance providers, which can translate to lower premiums for consumers.

Emerging Trends and Innovations

Several trends and innovations are shaping the on-demand insurance landscape. These include:

- Integration with mobile apps: On-demand insurance is increasingly integrated with mobile apps, providing instant access to coverage and claims processing.

- AI-powered risk assessment: Artificial intelligence is being used to more accurately assess risk and personalize premiums, leading to more accurate and fair pricing models.

- Partnerships with other businesses: Insurance providers are partnering with ride-sharing companies, delivery services, and other businesses to offer on-demand insurance tailored to specific needs within those sectors.

- Subscription-based models: The use of subscription-based models is gaining traction, providing customers with continuous access to insurance coverage.

Competitive Landscape

The on-demand insurance market is becoming increasingly competitive. Established insurance companies are entering the space, while new startups are leveraging technology to offer innovative products. Competition is not just limited to the direct insurance providers, but also involves platforms facilitating these insurance services. This dynamic landscape requires providers to continuously innovate and adapt to stay ahead of the curve.

Key Players in the On-Demand Insurance Market

| Company | Products | Target Audience |

|---|---|---|

| Insurtech A | On-demand car insurance, travel insurance | Drivers, travelers |

| Insurtech B | On-demand home insurance, pet insurance | Homeowners, pet owners |

| Traditional Insurer X | On-demand health insurance, business insurance | Small businesses, individuals |

| Gig Economy Platform Y | Insurance packages for delivery drivers, freelance workers | Gig economy workers |

Technology and Platforms

On-demand insurance relies heavily on technology to function effectively. It streamlines processes, reduces costs, and provides a more personalized experience for customers. The role of technology in this sector is pivotal, enabling insurers to adapt quickly to changing customer needs and market demands.Technology is revolutionizing the insurance industry, moving away from traditional, often cumbersome, methods. This disruption is evident in how on-demand insurance models are built around agility, speed, and customer-centricity.

Insurers are leveraging technology to create more accessible and affordable insurance solutions, tailoring coverage to specific needs in real-time.

Role of Technology in Enabling On-Demand Insurance

Technology plays a critical role in enabling on-demand insurance by automating processes, reducing administrative overhead, and allowing for real-time pricing and policy adjustments. This leads to a more responsive and efficient insurance system. For example, automated underwriting systems can process applications rapidly, while digital platforms allow for easy policy management and claims filing.

Disruption of Traditional Insurance Models

Traditional insurance models are being disrupted by technology’s ability to gather and analyze vast amounts of data. This data-driven approach allows for more accurate risk assessment and personalized pricing, making insurance more accessible and affordable for a wider range of individuals and businesses. Machine learning algorithms can identify patterns and trends in data, enabling more targeted and efficient risk management.

On-demand insurance is becoming more popular, and it’s interesting to see how it connects with decentralized finance (DeFi). Decentralized finance (DeFi) offers innovative ways to manage risk, which could potentially improve the efficiency and accessibility of on-demand insurance products. This could lead to a more transparent and affordable system for everyone.

Technologies Used in On-Demand Insurance Platforms

Various technologies are employed in on-demand insurance platforms to enhance efficiency and user experience. These include:

- Cloud Computing: Cloud-based platforms offer scalability, flexibility, and cost-effectiveness for on-demand insurance services, enabling insurers to adapt quickly to changing demands. This is particularly important for handling surges in policy applications or claims.

- API Integrations: APIs allow seamless integration with other services, such as payment gateways, identity verification systems, and telematics devices, creating a unified and efficient user experience.

- Mobile Applications: Mobile apps facilitate easy access to policies, claims filing, and customer support, enabling users to manage their insurance needs on the go. This is a critical feature for on-demand insurance, enabling quick access and responsiveness.

- Big Data Analytics: Utilizing big data analytics allows for comprehensive risk assessment, personalized pricing, and the development of more tailored insurance products. Insurers can identify trends and patterns to refine pricing and coverage.

Importance of Data Analytics in On-Demand Insurance

Data analytics is crucial for the success of on-demand insurance. By analyzing vast amounts of data, insurers can gain insights into customer behavior, risk patterns, and market trends. This data-driven approach allows for more accurate pricing, personalized coverage, and improved risk management. Real-time data analysis is vital to adjusting pricing and coverage based on current circumstances.

Technology Stack of On-Demand Insurance Platforms

The following table illustrates the diverse technology stacks employed by various on-demand insurance platforms:

| Platform | Technology | Feature |

|---|---|---|

| InsurTech Platform A | Cloud Computing (AWS), API Integrations (Stripe), Mobile App (React Native) | Scalable infrastructure, secure payments, user-friendly mobile experience |

| InsurTech Platform B | Cloud Computing (Azure), Big Data Analytics (Hadoop), Machine Learning (TensorFlow) | Advanced risk assessment, personalized pricing, real-time data analysis |

| InsurTech Platform C | Cloud Computing (Google Cloud), Telematics Integration, Blockchain | Optimized claim processing, enhanced security, transparent transactions |

Customer Experience and Value Proposition

On-demand insurance offers a fresh perspective on the traditional insurance model, focusing on a more customer-centric and flexible approach. This shift allows for a tailored experience that better meets the evolving needs of consumers in today’s dynamic environment. This section delves into the unique customer experience, benefits, and value proposition of on-demand insurance, highlighting its advantages over traditional methods and addressing the pain points customers often face with existing systems.

Unique Customer Experience

On-demand insurance prioritizes a streamlined and personalized customer journey. Unlike traditional insurance, which often involves complex paperwork and lengthy processes, on-demand solutions provide instant quotes and coverage, enabling users to access protection when and where they need it. This agility and ease of access significantly enhance the overall customer experience.

Benefits and Advantages for Consumers

Consumers benefit from on-demand insurance in several ways. Firstly, the immediate access to coverage is a significant advantage, offering protection for unforeseen circumstances without lengthy delays. Secondly, the personalized pricing and coverage options cater to specific needs, reducing unnecessary costs and ensuring appropriate protection. Finally, the user-friendly platforms and digital interfaces make the entire process straightforward and convenient.

Value Proposition Compared to Traditional Insurance

On-demand insurance distinguishes itself from traditional insurance models by offering a more flexible, transparent, and affordable approach. Traditional insurance often involves high premiums and complex policies that are difficult for consumers to understand. On-demand insurance, in contrast, provides clear and concise pricing, offering customers greater control over their coverage and cost. This transparency fosters trust and enhances the customer experience.

Pain Points Addressed

Traditional insurance systems often face criticism for their bureaucratic processes, high costs, and lack of personalization. Customers frequently encounter difficulties understanding policy terms, navigating claims processes, and securing coverage for niche needs. On-demand insurance directly addresses these pain points by providing a simple, transparent, and personalized experience that minimizes these frustrations.

On-demand insurance is becoming increasingly popular, and it’s a field that’s being rapidly transformed by technology. Think about how algorithmic trading is impacting financial markets; similar principles are being applied to assess risk and pricing in on-demand insurance products. This allows for more personalized and efficient policies, potentially making insurance more accessible and affordable. Algorithmic trading is already disrupting the traditional insurance industry by enabling faster, data-driven decisions.

Customer Journey Comparison

| Step | Traditional Insurance | On-Demand Insurance |

|---|---|---|

| Identifying need for insurance | Often triggered by a significant event or renewal date. | Can be triggered by immediate needs or proactive planning. |

| Obtaining a quote | Involves extensive paperwork, potentially multiple calls, and waiting periods. | Instantaneous quotes through digital platforms, allowing for quick comparison. |

| Selecting coverage | Limited options based on pre-defined packages; customization is restricted. | Flexible and customizable coverage tailored to specific needs. |

| Purchasing insurance | Requires physical visits or extensive online procedures, potentially involving lengthy approvals. | Quick and seamless purchase through digital platforms. |

| Claim process | Often complex and time-consuming, involving documentation and verification processes. | Streamlined claim process with digital documentation and faster resolution. |

Regulatory and Legal Aspects

Navigating the legal and regulatory landscape is crucial for the success of on-demand insurance. These aspects impact everything from the types of insurance that can be offered to how providers interact with customers and manage risks. Understanding these intricacies is essential for businesses to operate legally and sustainably.The regulatory environment for on-demand insurance is still evolving and varies significantly by jurisdiction.

Different countries and regions have unique laws and regulations regarding insurance products, particularly those delivered digitally and dynamically. This creates challenges for businesses seeking to operate in multiple markets, as compliance with each jurisdiction’s rules is paramount.

Regulatory Landscape for On-Demand Insurance Products

The regulatory landscape for on-demand insurance products is complex and fragmented. Insurance regulations are often designed for traditional insurance models and may not perfectly align with the unique characteristics of on-demand offerings. This can lead to challenges in defining coverage, pricing, and risk assessment. Existing regulations may need to be adapted or new regulations developed to address the specific requirements of on-demand insurance.

Legal Implications of Offering On-Demand Insurance

Offering on-demand insurance has several legal implications. Contractual agreements between the insurer and the customer need to be clearly defined, encompassing aspects like coverage limits, policy terms, and dispute resolution procedures. The legal implications also extend to data privacy and security. Providers must ensure that customer data is handled responsibly and securely, in compliance with data protection regulations like GDPR.

Compliance Considerations for On-Demand Insurance Providers

Compliance is a major concern for on-demand insurance providers. Ensuring that all operations are aligned with relevant laws and regulations is crucial for avoiding penalties and maintaining consumer trust. Key considerations include licensing requirements, adherence to anti-money laundering (AML) and know-your-customer (KYC) regulations, and the appropriate handling of claims and disputes. These factors significantly impact the operational costs and legal infrastructure needed by on-demand insurance providers.

On-demand insurance is becoming increasingly popular, offering flexibility and convenience. It’s a pretty cool concept, but its future success might also depend on aligning with sustainable practices, like ESG investing ESG investing. This means companies offering on-demand insurance will need to consider their environmental, social, and governance impact to attract investors and customers alike.

Impact of Regulatory Environment on On-Demand Insurance Growth

The regulatory environment significantly impacts the growth of on-demand insurance. Clear and supportive regulations can foster innovation and attract investment, whereas unclear or restrictive regulations can stifle market development. Favorable regulatory environments create a predictable business climate, encouraging market entry and the adoption of new technologies.

On-demand insurance is becoming super popular, offering flexible coverage for various needs. It’s similar to how Buy Now Pay Later (BNPL) services let you spread out payments for purchases, allowing you to access insurance without a large upfront cost. This approach makes insurance more accessible to a wider range of people.

Regulatory Requirements for Different Types of On-Demand Insurance

Different types of on-demand insurance products require varying regulatory approaches. A standardized table illustrating the regulatory requirements for various types of on-demand insurance will be helpful in understanding the nuances.

| Insurance Type | Regulatory Body | Requirements |

|---|---|---|

| Ride-sharing insurance | State insurance departments (e.g., California Department of Insurance) | Licensing requirements, specific coverage provisions, compliance with motor vehicle laws, and claims handling procedures. |

| Travel insurance | National insurance regulators (e.g., the US Department of Insurance) | Coverage limitations, policy provisions, claims processing standards, and adherence to consumer protection laws. |

| Pet insurance | State insurance commissioners (e.g., New York State Department of Financial Services) | Licensing mandates, contract stipulations, risk assessment frameworks, and claims processing guidelines. |

| Event cancellation insurance | Local or state insurance regulators | Coverage details, policy conditions, claims handling protocols, and adherence to local event regulations. |

Future of On-Demand Insurance

On-demand insurance is poised for significant growth and transformation in the coming years. The flexibility and tailored approach offered by this model are highly attractive to both consumers and businesses, leading to a dynamic future. The integration of emerging technologies will play a crucial role in shaping this evolution.The future of on-demand insurance is characterized by a greater emphasis on personalization, real-time risk assessment, and seamless integration with other services.

This shift will be driven by advancements in technology and a growing awareness of the benefits of this approach among consumers and businesses alike.

Predictions for Future Evolution

On-demand insurance is expected to become increasingly sophisticated, adapting to evolving consumer needs and technological advancements. This will involve a shift towards dynamic pricing models, based on real-time risk assessments and usage patterns. Further development will see a move towards more personalized and tailored coverage, enabling customers to access specific types of insurance for specific needs or durations.

Insurance will likely become more intertwined with other services, such as ride-sharing or delivery platforms, offering bundled packages.

Potential Challenges and Opportunities

One of the key challenges is maintaining trust and transparency in the system. This involves ensuring clear communication about coverage, pricing, and claim processes. Furthermore, the regulatory environment for on-demand insurance needs to adapt to this new model to avoid potential loopholes and protect consumers. Opportunities exist in creating innovative insurance products for niche markets, such as short-term rental insurance or gig economy workers’ protection.

Another significant opportunity lies in the potential for increased efficiency and cost savings through automation and data analysis.

Emerging Technologies

Several emerging technologies will profoundly impact the on-demand insurance landscape. Blockchain technology offers a potential solution for enhanced transparency and security in managing claims and policy information. The rise of the Internet of Things (IoT) will allow for more accurate risk assessments, enabling dynamic pricing adjustments in real-time based on factors such as driving behavior or home security systems.

Furthermore, AI and machine learning algorithms will play a key role in automating claims processing and underwriting, leading to a more efficient and cost-effective insurance process.

Impact of Societal Trends

Societal trends, such as the increasing prevalence of remote work, gig economy participation, and a growing awareness of financial literacy, will influence the demand for on-demand insurance. These trends highlight the need for flexible and adaptable insurance products. For example, on-demand insurance could cater to the needs of freelancers and contractors by offering short-term, project-based coverage.

AI and Machine Learning Impact

AI and machine learning algorithms will have a profound effect on on-demand insurance. These technologies can analyze vast amounts of data to identify risk patterns and price insurance policies accordingly. Furthermore, AI-powered chatbots can handle customer inquiries and claims efficiently, reducing wait times and improving customer experience. An example of this would be an AI-powered system analyzing driving data to assess risk in real-time, adjusting premiums dynamically.

Case Studies and Examples: On-demand Insurance

On-demand insurance is rapidly evolving, and real-world examples are crucial for understanding its practical application and impact. Analyzing successful implementations reveals valuable insights into the strengths and challenges of this dynamic model. These examples demonstrate how innovative companies are using technology to deliver tailored insurance solutions to meet specific customer needs.Successful on-demand insurance models often leverage technology to streamline processes, reduce costs, and offer greater flexibility to customers.

This flexibility and personalization are key differentiators, often leading to improved customer satisfaction and loyalty.

Real-World Examples of Successful Implementations

Several companies are successfully implementing on-demand insurance models. Their experiences offer valuable lessons for the industry, demonstrating how this approach can adapt to specific market needs.

Specific On-Demand Insurance Products

On-demand insurance products cater to diverse needs, ranging from short-term travel insurance to event-specific coverage. One prominent example is the use of on-demand insurance for ride-sharing services. This allows drivers to purchase insurance only when they are actively driving, significantly reducing premiums compared to traditional coverage. Another example is surge pricing insurance for delivery services, where drivers can purchase extra coverage when dealing with high-demand situations.

Impact on the Insurance Industry, On-demand insurance

The emergence of on-demand insurance is reshaping the traditional insurance landscape. This innovative approach is challenging established models by offering greater flexibility and personalization to consumers. This, in turn, fosters a more competitive market, encouraging insurers to adapt and innovate to remain relevant.

Key Case Studies

These case studies highlight the successful implementation of on-demand insurance models across various industries. They illustrate the diverse applications and potential of this emerging field.

| Case Study | Company | Outcome |

|---|---|---|

| Ride-Sharing Insurance | Various ride-sharing platforms (e.g., Uber, Lyft) | Reduced premiums for drivers, increased flexibility in coverage, improved driver retention, and enhanced customer satisfaction. |

| Event-Specific Travel Insurance | Travel booking platforms (e.g., Expedia, Booking.com) | Increased insurance options for travelers with short-term needs, allowing customization and tailoring to specific events or activities. |

| On-Demand Pet Insurance | Digital pet insurance platforms | Convenience for pet owners, cost-effective coverage options, and potential for better utilization of data for more personalized risk assessment and pricing. |

Closing Notes

Source: com.my

In conclusion, on-demand insurance is poised for significant growth, driven by technological innovation and consumer demand for flexible and accessible coverage. The future of insurance likely lies in a blend of traditional and on-demand models, creating a more dynamic and customer-focused experience. While challenges exist, the potential for disruption and improvement is immense, promising a future where insurance is more accessible, affordable, and tailored to individual needs.

Answers to Common Questions

What are some examples of on-demand insurance products?

On-demand insurance products can include things like ride-sharing insurance, short-term trip insurance, or even event-specific coverage, such as for a concert or festival.

How does on-demand insurance differ from traditional insurance?

Traditional insurance usually involves a set policy period, whereas on-demand insurance provides coverage only when needed. This is often triggered by an event, like a specific trip or rental.

Is on-demand insurance regulated?

Yes, the regulatory landscape for on-demand insurance is still evolving. Different types of on-demand insurance will have varying regulatory requirements.

What are the potential challenges of on-demand insurance?

Challenges include ensuring sufficient risk assessment, maintaining appropriate levels of financial security, and adapting to rapidly changing technological landscapes.