Digital insurance is revolutionizing how we think about and experience insurance. It’s a new way to access coverage, manage policies, and file claims, making the process easier and more convenient for everyone. This approach leverages technology to streamline the entire insurance lifecycle, from application to payment.

From personalized quotes to instant policy issuance, digital insurance platforms are built to cater to the modern customer. These platforms use data analytics and machine learning to provide tailored solutions and competitive pricing. The shift to digital insurance reflects a broader trend toward efficiency and customer-centricity in the industry.

Defining Digital Insurance

Source: walkme.com

Digital insurance is a rapidly evolving landscape, reimagining the traditional insurance model through technology. It leverages digital platforms, data analytics, and automation to deliver more efficient, personalized, and accessible insurance products and services. This shift is transforming the industry, impacting everything from policy management to claims processing.Digital insurance offers a significant departure from traditional methods, streamlining processes, and making the entire experience more convenient for customers.

This evolution brings significant benefits to both consumers and providers, leading to a more dynamic and responsive insurance ecosystem.

Key Characteristics of Digital Insurance

Digital insurance is characterized by its use of technology to automate processes, personalize policies, and gather data to improve risk assessment. Key features include:

- Automation: Digital platforms automate tasks like policy issuance, claims processing, and customer service interactions. This reduces manual intervention and speeds up the entire process.

- Data-Driven: Digital insurance utilizes vast amounts of data to analyze risk profiles, personalize premiums, and improve the accuracy of claims assessments. Examples include using driving habits to adjust car insurance premiums.

- Accessibility: Digital insurance is typically accessible 24/7 via online platforms, making it more convenient for customers to manage their policies and make changes.

- Personalization: Digital insurance platforms can tailor policies and services to individual customer needs and preferences. This allows for customized premiums and tailored coverage options.

Traditional vs. Digital Insurance Models

Traditional insurance relies heavily on physical documents, agents, and manual processes. Digital insurance leverages technology to replace or augment these methods, creating a more efficient and often cheaper alternative.

- Traditional Insurance: Typically involves lengthy paperwork, in-person interactions with agents, and a more cumbersome claims process.

- Digital Insurance: Focuses on online applications, automated underwriting, and efficient digital claim handling. This can reduce processing time significantly.

Evolution of Insurance Models

Insurance has evolved from a predominantly manual and agent-driven model to a digitally-focused system. Early forms of insurance were often localized and relied on physical interactions. The advent of computers and the internet led to the creation of online platforms, allowing for greater accessibility and efficiency. This evolution continues with the development of AI and machine learning, further optimizing risk assessment and personalization.

Examples of Digital Insurance Products and Services

Digital insurance extends beyond traditional policies to include specialized services and products.

- Travel Insurance: Digital platforms allow for quick and easy purchase of travel insurance policies, often tailored to specific destinations and activities.

- Pet Insurance: Many digital platforms now offer pet insurance, allowing for personalized coverage based on breed, age, and other factors.

- Health Insurance: Digital platforms facilitate online enrollment, premium payments, and access to health records. Some offer virtual doctor consultations.

- Cyber Insurance: Specialized digital platforms provide coverage for cyber risks and data breaches, an area of growing concern in the digital age.

Key Elements of a Digital Insurance Platform

A robust digital insurance platform requires several key elements to function effectively.

| Element | Description |

|---|---|

| User Interface | The user interface (UI) is the customer’s primary point of interaction with the platform. It should be intuitive, user-friendly, and provide easy access to all relevant features, including policy management, claims filing, and customer service options. |

| Claims Process | A digital claims process streamlines the claims submission and assessment procedure. It often involves online forms, digital documentation uploads, and automated claim approval workflows. |

| Policy Management | The policy management system allows users to access and manage their policy details, make changes, and view their coverage. It often integrates with payment systems and allows for seamless policy updates. |

Key Technologies Driving Digital Insurance

Digital insurance is rapidly transforming the industry, leveraging technology to improve efficiency, customer experience, and risk management. This transformation is fueled by a confluence of powerful technologies, each contributing to a more streamlined and personalized insurance landscape. These technologies are not just tools, but the very foundations upon which the future of insurance is being built.

Digital insurance is becoming increasingly popular, offering convenience and speed. It’s changing how we think about insurance, and it’s also impacting other digital financial services like digital loans, which are revolutionizing access to credit. Digital loans are often linked to broader digital financial ecosystems, making it easier for people to manage their finances overall. This interconnectedness ultimately benefits the entire digital insurance space.

Cloud Computing

Cloud computing is a cornerstone of digital insurance. It allows insurers to store and process vast amounts of data, enabling more sophisticated risk assessments and personalized pricing models. The scalability of cloud platforms is crucial for handling fluctuating demands during peak periods or when new policyholders join. This scalability also helps insurers quickly adapt to evolving market conditions and emerging risks.

Companies can also benefit from reduced infrastructure costs and increased agility by using cloud services. For example, a cloud-based platform allows an insurer to easily scale up its processing capacity during peak seasons, like the hurricane season, without needing to invest heavily in physical infrastructure.

Artificial Intelligence (AI), Digital insurance

AI is revolutionizing the insurance sector through its ability to automate tasks, improve decision-making, and enhance customer interactions. AI-powered chatbots can provide instant support, answer policyholder queries, and process claims efficiently. Furthermore, AI algorithms can analyze massive datasets to identify patterns and predict future risks, leading to more accurate pricing and tailored insurance products. For instance, AI can analyze a driver’s driving history, location, and habits to create a customized car insurance policy with a price based on their risk profile.

Blockchain

Blockchain technology is gaining traction in digital insurance for its potential to enhance transparency, security, and efficiency in claims processing. Its decentralized nature and immutable records can create a more secure and transparent system, streamlining claim settlements and reducing fraud. This could potentially lead to faster processing times and lower costs for both insurers and policyholders. For instance, blockchain could track the movement of a car’s ownership history, ensuring that the insured party is the rightful owner and reducing the possibility of fraudulent claims.

Data Analytics

Data analytics plays a critical role in understanding customer behavior, identifying trends, and predicting future risks. Insurers can use data analytics to create personalized pricing models, segment customers based on risk profiles, and develop targeted marketing campaigns. For example, an insurance company can analyze data from social media and other online platforms to better understand customer behavior and predict potential risks.

| Technology | Benefits | Drawbacks |

|---|---|---|

| AI | Improved risk assessment, automated claims processing, personalized pricing, enhanced customer service | Potential bias in algorithms, need for significant data sets, potential job displacement |

| Blockchain | Enhanced security and transparency, faster claim processing, reduced fraud | Complexity of implementation, potential scalability issues, regulatory uncertainties |

| Cloud Computing | Scalability, cost-effectiveness, accessibility, increased agility | Security concerns, reliance on internet connectivity, vendor lock-in |

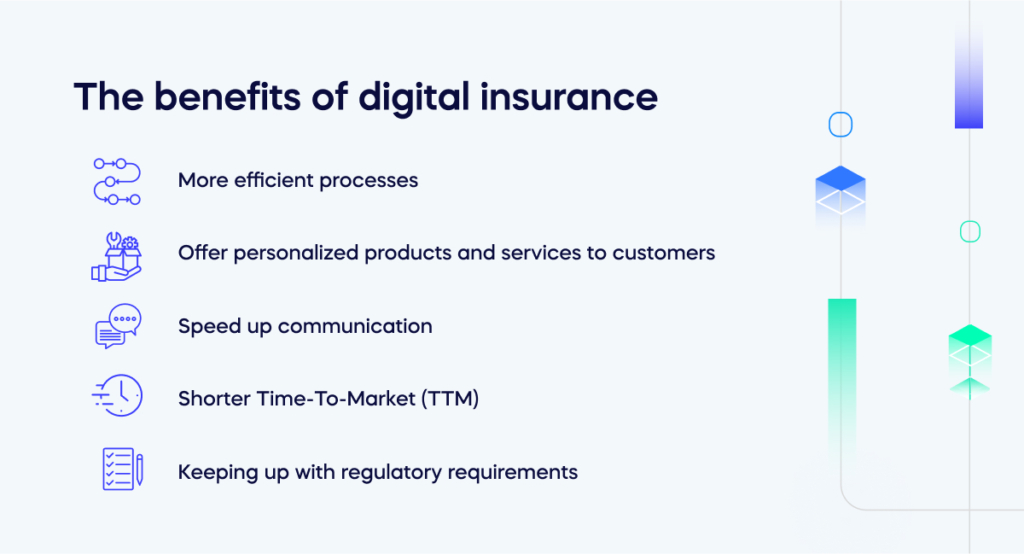

Benefits and Challenges of Digital Insurance

Digital insurance platforms are rapidly transforming the insurance industry, offering customers a more convenient and often more affordable way to access coverage. This shift brings both significant advantages and some inherent challenges that need careful consideration. Understanding these facets is crucial for both consumers and insurers navigating this evolving landscape.

Advantages of Digital Insurance Platforms

Digital insurance platforms provide a multitude of benefits, making the process more streamlined and accessible. These platforms leverage technology to offer customized policies, 24/7 access to information, and efficient claims processing.

- Convenience and Accessibility: Customers can access policies, make payments, and file claims from anywhere with an internet connection. This eliminates the need for physical visits to offices and reduces administrative burden.

- Personalized Experiences: Digital platforms allow for tailored policy recommendations based on individual needs and risk profiles. This leads to more appropriate coverage and potential cost savings.

- Faster Claims Processing: Digital systems often automate claim verification and approval processes, leading to quicker payouts. This is especially valuable in situations requiring immediate assistance.

- Lower Costs: Reduced administrative overhead and automated processes often translate to lower premiums for customers. This can be a significant factor, particularly for smaller policies.

- Enhanced Transparency: Digital platforms offer clear visibility into policy details, coverage limits, and claim statuses. This fosters trust and simplifies understanding the insurance contract.

Challenges and Limitations of Digital Insurance

Despite the numerous advantages, digital insurance platforms also face challenges that require ongoing attention and improvement. These limitations range from cybersecurity concerns to the need for robust digital literacy.

- Security Concerns: Protecting sensitive customer data is paramount. Cyberattacks and data breaches are potential risks that need to be mitigated through robust security measures.

- Digital Literacy: Not all consumers are comfortable with or possess the necessary skills to navigate digital platforms. This creates a barrier to entry for some demographics.

- Lack of Personal Interaction: The reliance on digital interfaces can sometimes lead to a disconnect between customers and insurers, potentially hindering personalized service and building trust.

- System Failures and Downtime: Technical glitches and system failures can disrupt access to critical services and cause significant inconvenience for customers.

- Integration Challenges: Integrating digital platforms with existing legacy systems can present technical hurdles and delays.

Impact on Customer Experience

Digital insurance has a profound impact on the customer experience. It has the potential to deliver a more streamlined, transparent, and convenient experience, but challenges remain in ensuring a positive and seamless interaction.

Digital insurance is becoming more convenient, and one key part of that is using QR code payments. This is streamlining the process for customers, allowing them to quickly pay premiums and manage their policies directly through their phones, which is a huge plus. These QR code payments are becoming more common, and as a result, digital insurance is improving in terms of user experience and efficiency.

Using a system like QR code payments makes it easier for everyone to stay on top of their insurance needs.

- Streamlined Processes: Digital platforms can streamline the entire insurance process, from purchasing a policy to filing a claim. This significantly reduces the time and effort required for insurance transactions.

- Increased Convenience: Customers can access information and manage their policies anytime, anywhere. This accessibility is a significant improvement over traditional methods.

- Improved Transparency: Digital platforms allow for clear and transparent communication, fostering trust and understanding.

- Potential for Dissatisfaction: Technical issues, lack of personal interaction, and a steep learning curve for some users can create negative experiences.

Comparison of Digital and Traditional Insurance Experiences

Digital insurance offers a more accessible and immediate experience compared to traditional insurance, but both have distinct advantages and disadvantages.

- Traditional Insurance: Traditional methods often rely on in-person interactions, which can be time-consuming. However, face-to-face interactions allow for detailed explanations and personalized advice. Claims processing can be slower.

- Digital Insurance: Digital insurance platforms offer instant access to policies and information. However, users must be comfortable with technology and may miss out on the personalized advice that traditional methods offer.

Cost Structures Comparison

The cost structures of digital and traditional insurance models differ significantly, reflecting the differing operational approaches.

| Factor | Digital Insurance | Traditional Insurance |

|---|---|---|

| Cost of Operations | Potentially lower due to automation and reduced overhead. | Higher due to physical infrastructure, personnel costs, and manual processes. |

| Cost to Customer | Potentially lower due to reduced administrative costs passed on to customers. | Potentially higher due to higher operational costs, which can be reflected in premiums. |

The Future of Digital Insurance

Digital insurance is rapidly evolving, driven by technological advancements and changing customer expectations. This transformation is poised to reshape the entire insurance landscape, offering both opportunities and challenges for insurers and consumers alike. The future promises greater efficiency, personalized experiences, and a more seamless interaction between policyholders and providers.

Digital insurance is becoming increasingly sophisticated, allowing for more personalized policies. A key part of this is effective portfolio management, which involves strategic decisions about which risks to insure and how to optimize coverage. This approach to Portfolio management is crucial for insurers to stay competitive and maximize returns while ensuring customer needs are met. Ultimately, smart portfolio management directly impacts the overall success of digital insurance platforms.

Emerging Trends and Future Developments

The digital insurance industry is experiencing a dynamic shift, with new technologies constantly emerging and reshaping the way policies are sold, managed, and claimed. AI-powered risk assessments, personalized policy recommendations, and automated claims processing are becoming increasingly prevalent. Expect to see a rise in the use of blockchain technology for secure data management and the integration of virtual reality and augmented reality for enhanced customer engagement.

Potential Disruptions in the Insurance Landscape

The traditional insurance industry is facing significant disruptions due to the rise of digital insurance platforms. New entrants, often with innovative business models, are challenging established players. This competitive environment forces established insurers to adapt rapidly or risk losing market share. Disruption is often driven by technological advancements that allow for greater efficiency, lower costs, and enhanced customer experiences.

The potential disruption comes from new competitors, new technologies, and changing customer expectations.

The Role of Personalization in Digital Insurance

Personalization is key to success in the digital insurance market. Insurers can use data analytics to tailor products and services to individual needs and preferences. This approach enhances customer satisfaction, increases engagement, and improves retention rates. Examples include customized risk assessments based on individual lifestyles, tailored premiums, and proactive policy recommendations.

Artificial Intelligence and Machine Learning in Digital Insurance

AI and machine learning are revolutionizing the digital insurance landscape. AI algorithms can analyze vast amounts of data to identify patterns and trends, enabling more accurate risk assessments and pricing models. Machine learning algorithms can also improve claims processing, predict future claims, and personalize customer interactions. This leads to more efficient processes and better service. For example, AI-powered chatbots can handle customer inquiries, reducing wait times and improving the overall customer experience.

Hypothetical Future Digital Insurance Product

Imagine a “Predictive Protection” service, a digital insurance product that leverages AI and wearable technology. Customers wear smartwatches or other devices that track their activity levels, health metrics, and lifestyle choices. The system analyzes this data and provides personalized insurance options based on the user’s individual risk profile. If a user consistently demonstrates healthy behaviors, the system could offer lower premiums and additional benefits, such as discounts on fitness programs or health consultations.

Conversely, if the system detects increased risk factors, it might offer preventive care options or suggest modifications to lifestyle choices to reduce the risk.

Case Studies and Examples

Digital insurance is rapidly transforming the industry, and numerous successful implementations showcase its potential. From streamlining processes to enhancing customer experience, innovative approaches are driving significant improvements in various sectors. These examples highlight how digital insurance can be a powerful tool for both insurers and policyholders.Many companies are leveraging technology to offer more personalized and efficient insurance products and services.

This has led to increased customer satisfaction and lower operational costs, making digital insurance a desirable choice for both insurers and consumers.

Digital insurance is becoming increasingly popular, offering convenient ways to manage policies and claims online. This is closely tied to the broader concept of digital finance, which encompasses a wide range of financial services delivered digitally. Digital finance is changing how people interact with their money, and this trend is also revolutionizing the insurance industry, making digital insurance more accessible and user-friendly for everyone.

Successful Digital Insurance Implementations

Several companies have successfully implemented digital insurance solutions, demonstrating the feasibility and benefits of this approach. One example involves a company that developed a mobile app for travel insurance. Users can easily purchase coverage, track their trip, and make claims directly through the app. This streamlined process enhances the customer experience and reduces administrative burden for the insurer.

Another notable implementation involves a digital health insurance platform that allows users to access their medical records and manage their claims online. This significantly reduces the time and effort required for managing health insurance, which is a huge benefit to users.

Innovative Approaches to Digital Insurance

Innovative approaches to digital insurance are emerging, and one prominent approach is the use of artificial intelligence (AI) and machine learning (ML) for risk assessment. These technologies can analyze vast amounts of data to more accurately assess risk, leading to more precise pricing and customized coverage options. Another innovative approach is the integration of digital insurance with other digital services, such as financial management apps or health tracking devices.

This allows for a more holistic and integrated approach to personal financial management.

Real-World Examples of Transformation

Digital insurance is transforming the industry by improving accessibility and affordability for consumers. A significant example is the use of telematics in car insurance. By monitoring driving habits through connected car technology, insurers can offer personalized premiums based on safe driving behaviors. This has proven to be successful, reducing costs for safe drivers while also encouraging responsible driving practices.

Another example involves the use of digital platforms to provide microinsurance to underserved populations. This approach makes insurance accessible to individuals who may not have had access to traditional insurance products.

Specific Use Cases in Various Industries

Digital insurance is finding applications across diverse industries. In the travel industry, digital platforms facilitate the purchase of travel insurance, enabling travelers to manage their policies and claims efficiently. In the healthcare sector, digital health insurance platforms streamline the claims process and provide patients with access to their medical records. These are just two examples of how digital insurance is being used in different industries.

Table of Digital Insurance Products

| Product Type | Description |

|---|---|

| Travel Insurance | Digital platforms allow users to purchase travel insurance, manage policies, and file claims easily, often through mobile apps. This includes options for trip interruption, medical emergencies, and baggage loss. |

| Health Insurance | Digital health insurance platforms offer online access to medical records, claim management, and secure communication with providers. This can also include tools for managing chronic conditions and accessing preventive care resources. |

| Home Insurance | Digital platforms allow users to assess their home’s risk factors, purchase coverage, and file claims online. This might involve integrating with home security systems for risk assessment and automated claims reporting. |

| Auto Insurance | Digital platforms facilitate the purchase and management of auto insurance policies. Features may include usage-based insurance (telematics), automated claims processing, and personalized policy recommendations. |

Regulatory and Legal Considerations: Digital Insurance

Digital insurance, while offering many advantages, is also subject to a complex web of regulations and legal frameworks. Navigating these legal hurdles is crucial for companies to operate effectively and build trust with customers. Compliance with these standards is essential to maintain stability and avoid potential legal issues.The legal landscape surrounding digital insurance is constantly evolving, demanding a proactive approach from companies to stay ahead of changes and adapt to new requirements.

This requires a deep understanding of the specifics in different jurisdictions, including data privacy, security, and product offerings.

Legal and Regulatory Frameworks for Digital Insurance

Digital insurance companies must adhere to a variety of regulations, often extending beyond traditional insurance frameworks. These regulations vary significantly by region and are tailored to address specific concerns related to digital technologies. For example, some regions may have more stringent regulations regarding data privacy, while others might focus on the specifics of online sales and contracts. Understanding and complying with these diverse regulations is critical for operating in multiple jurisdictions.

Implications of Data Privacy and Security

Data privacy and security are paramount in digital insurance. The collection, storage, and use of customer data must adhere to stringent regulations, such as GDPR in Europe and CCPA in California. Failure to comply can lead to substantial fines and reputational damage. Companies need robust security measures to protect sensitive information and ensure compliance with privacy standards.

Digital insurance is changing the game, making things easier and more efficient. It leverages technology, but a key component is the use of smart contracts, which automate processes and reduce fraud. These self-executing contracts are revolutionizing how agreements are managed, ensuring trust and security in the insurance industry. Smart contracts are really transforming the way policies are handled, from claims processing to policy administration.

This ultimately leads to a better, more streamlined experience for everyone involved in digital insurance.

Challenges Related to Compliance in Digital Insurance

Several challenges exist regarding compliance in the digital insurance sector. The rapid pace of technological advancements often outpaces regulatory updates, creating a gap that companies must bridge. Additionally, ensuring consistent compliance across multiple jurisdictions with varying regulations can be complex and resource-intensive. The interpretation and application of regulations also vary, creating potential inconsistencies and ambiguities.

Examples of Relevant Regulations in Different Regions

Different regions have specific regulations related to digital insurance. For example, the EU’s General Data Protection Regulation (GDPR) mandates strict data protection measures for all companies operating within the EU. The California Consumer Privacy Act (CCPA) similarly provides specific rights to California residents regarding their personal data. These examples illustrate the diverse regulatory landscape and the need for companies to understand the specific requirements in each region where they operate.

Legal Requirements for Digital Insurance Products and Services

Digital insurance products and services must meet specific legal requirements, including clarity in contracts, transparency in pricing, and appropriate disclosures to customers. These requirements ensure fair and equitable practices, protecting consumers from misleading or unfair treatment. Furthermore, the legal frameworks for digital insurance must address the unique aspects of online interactions, including electronic signatures, online dispute resolution, and the use of artificial intelligence.

Conclusion

In conclusion, digital insurance is transforming the insurance landscape, offering a more efficient and customer-focused experience. While challenges remain, the potential for innovation and disruption is significant. The future of digital insurance is bright, promising even more advanced features and accessibility for everyone.

Answers to Common Questions

What are the common security concerns associated with digital insurance?

Data breaches and privacy violations are potential concerns. Digital insurance platforms must prioritize robust security measures to protect sensitive customer information. Regulations like GDPR and CCPA also play a crucial role in data security.

How does digital insurance impact the insurance industry’s workforce?

The adoption of digital insurance is changing roles and responsibilities. There’s a need for specialized roles in areas like data analysis, technology implementation, and customer support. However, some traditional roles might become obsolete or need re-skilling.

What are the different types of digital insurance products available?

Digital insurance encompasses various product types, such as travel insurance, health insurance, auto insurance, and more. The range is constantly expanding to meet diverse needs and market demands.

How do digital insurance platforms handle claims?

Digital platforms often use online portals or mobile apps for easy claim filing and tracking. Automation and streamlined processes significantly reduce the time it takes to settle claims.