Digital assets sets the stage for a fascinating exploration into the rapidly evolving world of online value. From cryptocurrencies to NFTs, these digital representations of ownership are transforming industries and challenging traditional financial models. This overview examines the core principles, potential risks, and future trajectory of this dynamic landscape.

This exploration delves into the multifaceted nature of digital assets, covering their diverse forms, valuation methods, security considerations, and legal frameworks. It also touches on emerging technologies, use cases across various sectors, and forecasts for the future. Understanding these elements is key to navigating the opportunities and challenges presented by this emerging asset class.

Introduction to Digital Assets

Digital assets are essentially any valuable item that exists in a digital format. They’re increasingly important in today’s economy, representing a shift from physical goods to intangible value. These assets can be used for various purposes, from artistic expression to financial transactions, and are often more accessible and adaptable than their physical counterparts.Digital assets differ significantly from traditional assets in their form, accessibility, and potential for rapid value fluctuations.

Traditional assets like land or gold have physical presence and are often governed by established legal frameworks. Digital assets, conversely, exist entirely within digital systems, leading to complexities in ownership, authentication, and regulatory oversight.

Key Characteristics of Digital Assets

Digital assets possess several distinguishing characteristics. They are often intangible, meaning they lack a physical form, and exist only as data encoded in computer systems. This digital nature facilitates easy replication, but also introduces the possibility of unauthorized duplication and the need for robust security measures. Furthermore, digital assets can be highly versatile, adaptable, and scalable, allowing for diverse applications across various sectors.

Their value often depends on factors like scarcity, demand, and technological advancements, which can cause rapid fluctuations in their market value.

Digital assets are becoming increasingly popular, and one way to get involved is through Initial Coin Offerings (ICO). Initial Coin Offering (ICO) s are essentially a way to raise capital for new crypto projects, but they also present risks. Ultimately, digital assets like these are a fascinating area of finance.

Types of Digital Assets

Digital assets encompass a wide range of forms. Their versatility is a defining characteristic, enabling diverse applications and industries.

- Cryptocurrencies: Digital or virtual currencies designed for secure online transactions. Examples include Bitcoin, Ethereum, and Litecoin. These currencies utilize cryptography to secure transactions and control the creation of new units.

- NFTs (Non-Fungible Tokens): Unique digital tokens representing ownership of a specific item or piece of content. NFTs are used to authenticate digital assets, such as art, music, and collectibles. Their scarcity and immutability are key characteristics.

- Digital Art and Music: Digital representations of artistic expressions, such as paintings, photographs, music files, and videos. The digital nature allows for easy distribution and sharing, but also poses challenges related to copyright and ownership.

- Software and Applications: Digital assets representing software code and applications. These assets can have significant financial value and are often sold or licensed.

- Data and Information: Digital assets encompassing various forms of data, including customer data, financial records, and research information. This type of asset has enormous value in today’s data-driven economy.

Digital Asset Categories

The following table illustrates the diverse categories of digital assets and provides brief descriptions for each.

| Category | Description |

|---|---|

| Cryptocurrencies | Digital or virtual currencies secured by cryptography, enabling secure online transactions. |

| NFTs | Unique digital tokens representing ownership of a specific digital asset, often used to authenticate digital art, collectibles, or other unique items. |

| Digital Media | Digital representations of artistic expressions, including music, videos, photographs, and digital art. |

| Software | Digital assets representing software code and applications, with significant potential financial value. |

| Data | Digital assets encompassing various forms of data, from customer information to financial records and research data. |

Security and Risk Management of Digital Assets

Protecting digital assets is crucial in today’s interconnected world. A robust security strategy is paramount to prevent unauthorized access, data breaches, and financial losses. This involves understanding the potential threats and implementing appropriate security protocols and measures.Digital assets, like cryptocurrencies and NFTs, are vulnerable to a range of cyberattacks, making proactive security measures essential. Failing to address these vulnerabilities can result in significant financial and reputational damage.

The value of digital assets necessitates a comprehensive understanding of the risks and a proactive approach to mitigation.

Major Security Risks Associated with Digital Assets

Understanding the specific risks associated with digital assets is the first step towards effective security. These risks range from technical vulnerabilities to social engineering tactics. A thorough risk assessment is necessary to prioritize vulnerabilities and develop targeted countermeasures.

- Compromised Private Keys: Loss or theft of private keys is a significant threat, allowing unauthorized access to wallets and control over digital assets. This often occurs due to phishing scams, malware infections, or compromised devices.

- Smart Contract Vulnerabilities: Smart contracts, while designed for automation, can contain vulnerabilities that hackers can exploit to steal funds or disrupt the contract’s intended functionality. Examples include reentrancy attacks, which can drain funds from a contract, and denial-of-service attacks that can halt the execution of the contract.

- Phishing and Social Engineering Attacks: These attacks leverage human psychology to trick individuals into revealing sensitive information like passwords or private keys. Phishing emails or messages impersonating legitimate platforms are common tactics.

- Denial-of-Service (DoS) Attacks: These attacks overwhelm a platform or service with traffic, rendering it unavailable to legitimate users. This can be particularly damaging to platforms hosting digital assets, preventing users from accessing or trading them.

- Malware and Viruses: Infections from malware or viruses can compromise devices, stealing private keys or sensitive information. Protecting against these threats requires robust antivirus software and up-to-date security measures.

Common Threats and Vulnerabilities

A detailed understanding of common threats and vulnerabilities is essential for effective risk mitigation. These include technical flaws, human error, and external factors.

- Exploiting Software Bugs: Vulnerabilities in the software used to manage or interact with digital assets can be exploited by attackers. These vulnerabilities might allow unauthorized access or manipulation of the underlying systems.

- Weak Passwords and Authentication: Weak or easily guessable passwords and authentication methods are often exploited to gain unauthorized access to accounts and digital assets. Using strong, unique passwords and multi-factor authentication are essential.

- Third-Party Integrations: Integrating with third-party services can introduce new vulnerabilities if the service is not adequately secure. Thoroughly researching and vetting third-party providers is vital.

- External Market Volatility: Fluctuations in the market value of digital assets can lead to unexpected losses. Diversification and proper risk assessment are crucial in managing this risk.

Importance of Security Protocols and Measures

Robust security protocols and measures are critical for safeguarding digital assets. This includes both technical and non-technical controls.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security by requiring multiple forms of verification to access accounts. This makes it harder for attackers to gain unauthorized access.

- Regular Security Audits: Regular security audits can identify vulnerabilities and weaknesses in systems and protocols. Proactive assessments can help prevent potential breaches.

- Strong Passwords and Password Management: Creating and managing strong, unique passwords is essential for protecting accounts and digital assets. Using a password manager can help.

Strategies for Mitigating Risks

Effective strategies are needed to manage the risks associated with digital asset ownership and management. This includes both proactive and reactive measures.

- Diversification of Assets: Distributing investments across different digital assets can reduce the impact of losses in a single asset.

- Secure Storage Solutions: Using secure storage solutions, such as hardware wallets, can protect private keys from unauthorized access.

- Regular Backups: Regularly backing up digital assets and storing them securely can prevent data loss in case of system failure.

Common Security Best Practices

Implementing security best practices is essential for protecting various digital asset types. These practices should be tailored to the specific asset type.

| Digital Asset Type | Security Best Practices |

|---|---|

| Cryptocurrencies | Use strong passwords, enable MFA, store keys securely (hardware wallets), monitor transactions, and avoid phishing scams. |

| NFTs | Store NFTs on secure platforms, use strong passwords, enable MFA, and be wary of scams and fraudulent marketplaces. |

| DeFi Tokens | Thoroughly research and understand the DeFi platform’s security protocols, use strong passwords, and enable MFA, and be aware of smart contract vulnerabilities. |

Legal and Regulatory Landscape of Digital Assets

The digital asset space is rapidly evolving, creating a complex legal and regulatory landscape. Governments worldwide are grappling with how to regulate this innovative sector, balancing the need to protect investors and consumers with the desire to foster innovation and economic growth. This ongoing process is characterized by differing approaches and varying levels of clarity.The absence of a universally accepted legal framework for digital assets presents significant challenges.

Jurisdictions are experimenting with different regulatory models, ranging from outright bans to permissive frameworks that aim to attract investment. This divergence creates uncertainty for businesses operating across borders and investors considering participation in the digital asset market.

Current Legal Frameworks Governing Digital Assets

Different jurisdictions have adopted various approaches to regulating digital assets. Some countries have treated cryptocurrencies as securities, while others have classified them as commodities or simply as a form of payment. This diverse treatment complicates cross-border transactions and makes it difficult for businesses to navigate the legal landscape. The lack of global harmonization creates regulatory arbitrage opportunities, leading to potential conflicts and inefficiencies.

Regulatory Approaches by Jurisdiction

The regulatory approach varies significantly from country to country. Some jurisdictions have adopted a cautious approach, imposing strict regulations on the issuance and trading of digital assets. Others have taken a more permissive stance, allowing for greater freedom of operation, but with a greater degree of risk for investors. The approach often depends on the specific digital asset, its use case, and the country’s existing regulatory framework.

For example, Switzerland has implemented a favorable framework for digital asset businesses, leading to the establishment of numerous blockchain and cryptocurrency companies.

Digital assets are becoming increasingly popular, and fintech startups are playing a huge role in making them more accessible. These startups are developing innovative platforms and services that simplify the buying, selling, and managing of digital assets, like cryptocurrencies and NFTs. This is driving a lot of interest and growth in the digital asset market overall.

Challenges and Ambiguities in Regulating Digital Assets

The rapidly evolving nature of the digital asset space presents significant challenges for regulators. The decentralized nature of many digital assets makes it difficult to enforce regulations and track transactions. Furthermore, the anonymity associated with some cryptocurrencies poses challenges for AML (Anti-Money Laundering) and KYC (Know Your Customer) compliance. The constant innovation in the space also leads to a dynamic regulatory environment that requires ongoing adaptation.

Potential Implications of New Regulations on the Digital Asset Market

New regulations will likely have significant implications for the digital asset market. Regulations may impact the pricing and trading of digital assets, potentially increasing transaction costs and limiting market liquidity. The regulatory landscape will also influence the development of new products and services, encouraging greater compliance and potentially impacting the competitive dynamics of the market. The introduction of regulatory frameworks could lead to a shift in investment strategies and the emergence of new investment opportunities, or, conversely, deter investment.

Key Legal and Regulatory Developments Impacting Digital Assets by Region

| Region | Key Developments |

|---|---|

| North America | The US Securities and Exchange Commission (SEC) has taken a proactive stance in regulating digital assets, with enforcement actions against several platforms. Other countries like Canada are actively developing their regulatory frameworks for digital assets. |

| Europe | The EU is working on a comprehensive regulatory framework for digital assets, aiming to create a unified approach across member states. This includes proposals for classifying cryptocurrencies and establishing rules for market participants. |

| Asia | Many Asian countries are exploring different regulatory approaches, with some taking a more cautious approach while others have introduced favorable frameworks to attract investment in blockchain technology. China’s stance on cryptocurrencies has been relatively strict. |

| Latin America | Latin American countries are still developing their regulatory frameworks for digital assets. There’s a mix of approaches, with some countries showing interest in fostering innovation while others remain cautious. |

Technological Advancements and Innovations

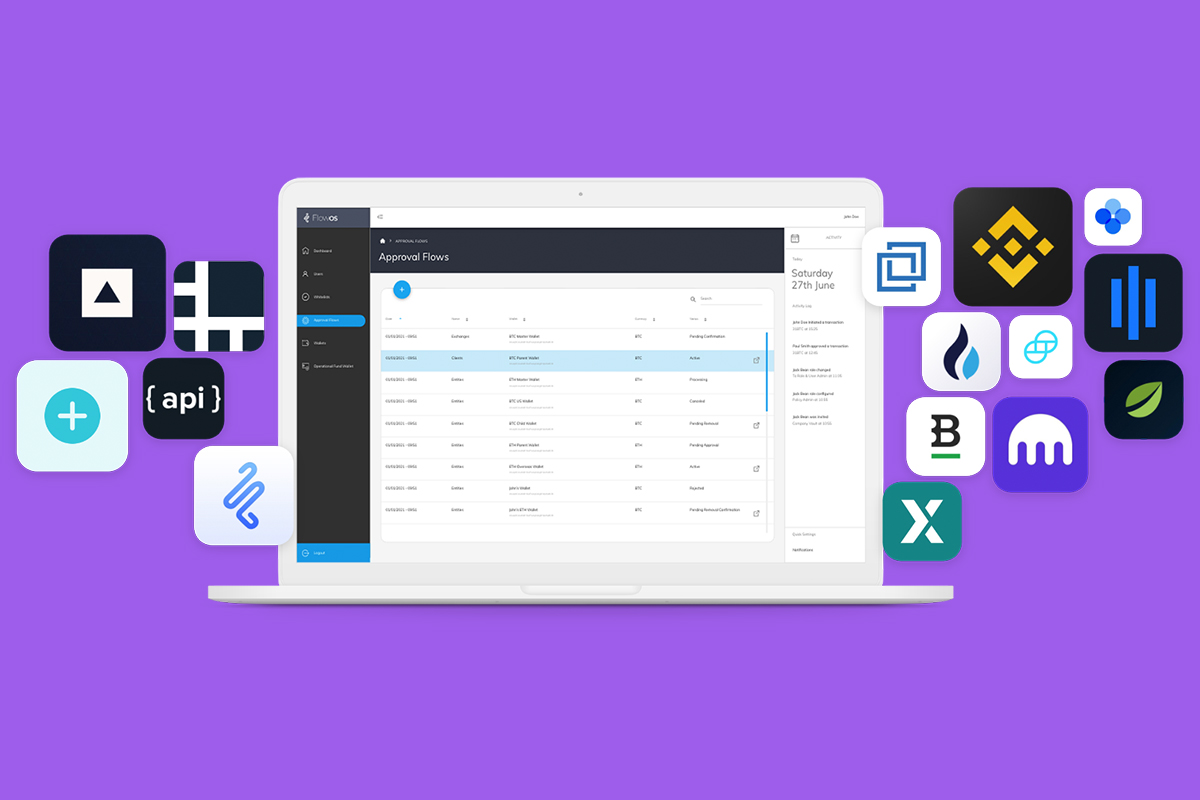

Source: flowos.co

Digital assets are becoming increasingly important, and services like Banking-as-a-Service (BaaS) Banking-as-a-Service (BaaS) are playing a key role in how they’re managed and accessed. This allows for easier integration of digital assets into existing financial systems, which ultimately benefits the entire digital asset ecosystem.

Digital assets are constantly evolving, driven by rapid advancements in technology. Emerging technologies are reshaping how these assets are created, stored, and traded, impacting their security, accessibility, and overall utility. This section explores these transformative forces, focusing on blockchain’s role in the digital asset ecosystem, the rise of decentralized finance (DeFi), and the comparative landscape of blockchain platforms.

Emerging Technologies Impacting Digital Assets

New technologies like artificial intelligence (AI), machine learning (ML), and the Internet of Things (IoT) are profoundly impacting the digital asset space. AI can enhance security protocols by identifying fraudulent activities, while ML algorithms can analyze vast datasets to predict market trends and optimize investment strategies. The IoT’s integration can create new possibilities for digital asset applications, potentially linking physical assets to digital representations, thereby opening up innovative use cases.

Blockchain’s Transformation of the Digital Asset Ecosystem

Blockchain technology forms the bedrock of many digital assets. Its decentralized and transparent nature facilitates secure transactions, verifiable ownership, and immutable records. This eliminates the need for intermediaries, reducing costs and increasing efficiency in the exchange of digital assets. Smart contracts, self-executing agreements embedded on a blockchain, automate processes and enforce agreements, further streamlining transactions and mitigating risks.

The Role of Decentralized Finance (DeFi)

Decentralized Finance (DeFi) leverages blockchain technology to create financial services without intermediaries. DeFi protocols offer various applications, including lending, borrowing, and trading, accessible directly through decentralized platforms. This democratizes access to financial instruments and fosters greater financial inclusion, especially in regions with limited traditional banking infrastructure. The growing DeFi ecosystem is characterized by innovation and experimentation, offering novel ways to manage and interact with digital assets.

Digital assets are becoming increasingly important in our financial world. One innovative way to use them is through QR code payments, a system that’s quickly gaining popularity. QR code payments offer a secure and convenient way to make transactions, and this technology is definitely changing how we think about digital assets in the future.

Comparison of Blockchain Platforms Supporting Digital Assets

Numerous blockchain platforms support digital assets, each with unique characteristics and capabilities. These platforms vary in their consensus mechanisms, transaction speeds, scalability, and security features. Understanding these differences is crucial for investors and developers to select the appropriate platform for their specific needs. Comparing and contrasting these platforms helps to evaluate their strengths and weaknesses.

Key Features and Benefits of Different Blockchain Platforms

| Blockchain Platform | Consensus Mechanism | Transaction Speed | Scalability | Security Features | Benefits |

|---|---|---|---|---|---|

| Ethereum | Proof-of-Work (PoW) and Proof-of-Stake (PoS) | Moderate | Good | Robust Smart Contract Framework | Mature ecosystem, diverse applications, widespread adoption |

| Bitcoin | Proof-of-Work (PoW) | Slow | Limited | Decentralized and secure | Established history, strong community, widely accepted |

| Solana | Proof-of-History (PoH) | Fast | High | Advanced consensus mechanism | High throughput, low latency, ideal for high-volume transactions |

This table provides a concise overview of key features. Specifics may vary depending on the implementation and updates. Further research is encouraged to gain a deeper understanding of individual platforms.

The Future of Digital Assets

The digital asset landscape is rapidly evolving, and its future holds both exciting possibilities and potential challenges. From decentralized finance (DeFi) applications to the integration of NFTs into various industries, the impact of digital assets on our economy and society is likely to be profound. Understanding the potential trends and developments is crucial for navigating this transformative period.

Potential Future Trends and Developments

The digital asset space is characterized by constant innovation. Expect advancements in blockchain technology, leading to more secure and efficient platforms. Furthermore, the integration of digital assets with the metaverse is expected to create entirely new avenues for commerce and interaction. The rise of decentralized autonomous organizations (DAOs) promises to reshape governance models in various sectors. Moreover, the growing adoption of digital identities and the integration of these identities with digital assets will potentially enhance security and streamline various processes.

Role of Digital Assets in a Future Economy

Digital assets are poised to play a significant role in the future economy. They can facilitate seamless transactions, streamline financial processes, and offer new investment opportunities. Imagine a future where international remittances are processed instantly and at minimal cost, powered by digital assets. Furthermore, the use of NFTs for unique digital ownership will empower creators and artists in new ways.

The potential of digital assets to disrupt traditional financial systems is undeniable.

Impact on Traditional Financial Systems

The integration of digital assets is likely to reshape traditional financial systems. Decentralized finance (DeFi) protocols, for instance, are challenging traditional banking models by offering alternative lending, borrowing, and trading mechanisms. The ability of digital assets to bypass intermediaries can reduce transaction costs and improve access to financial services. Cryptocurrencies, as an example, have already demonstrated the potential to enable cross-border payments and provide access to financial services in underserved markets.

Projections for Growth and Adoption, Digital assets

The adoption of digital assets is projected to accelerate in the coming years. Increased accessibility through user-friendly interfaces and more robust regulatory frameworks will likely drive this adoption. The growing recognition of digital assets as a legitimate investment class is another crucial factor. The ongoing development of applications like NFTs and DeFi will further enhance the appeal and utility of digital assets.

Predictions and Potential Scenarios

| Scenario | Prediction | Potential Impact |

|---|---|---|

| Mass Adoption | Widespread use of digital assets for everyday transactions and investment. | Disruption of traditional financial systems, increased access to financial services, new economic opportunities. |

| Regulatory Uncertainty | Continued regulatory uncertainty and volatility in the market. | Slowdown in adoption, market corrections, and potential risks for investors. |

| Technological Advancements | Breakthroughs in blockchain technology and digital asset applications. | Enhanced security, efficiency, and utility of digital assets, leading to new use cases and applications. |

| Integration with Metaverse | Significant integration of digital assets within the metaverse. | Creation of new economic opportunities, new ways to interact and trade, potential for virtual real estate and digital ownership. |

Digital Asset Use Cases

Digital assets are rapidly expanding beyond their initial applications in finance, impacting various sectors and reshaping existing business models. This exploration delves into diverse use cases, showcasing how these assets are transforming industries, and examining the associated benefits and drawbacks. From art and gaming to supply chain management, the applications are becoming increasingly innovative and complex.

Applications in Finance

Digital assets are significantly impacting financial services. Cryptocurrencies, for example, are being used for peer-to-peer transactions, reducing reliance on traditional banking systems. Stablecoins, designed to maintain a fixed value relative to fiat currencies, are facilitating cross-border payments and reducing transaction costs. Decentralized finance (DeFi) platforms are emerging, offering alternative financial services, like lending and borrowing, without intermediaries.

Digital assets are becoming increasingly popular, and one way people are acquiring them is through Buy Now Pay Later (BNPL) services. Buy Now Pay Later (BNPL) options make it easier to purchase digital assets like NFTs or cryptocurrencies, making them more accessible. This flexibility is a key factor driving the growth of the digital asset market.

These platforms often leverage smart contracts for automated transactions.

Applications in Art and Collectibles

Digital art, NFTs (Non-Fungible Tokens), and digital collectibles are transforming the art world. Artists can directly connect with collectors, bypassing traditional galleries and intermediaries. This direct access allows artists to retain more of the revenue generated from their work. Digital ownership records, secured by blockchain technology, provide transparency and authenticity. NFTs also facilitate fractional ownership of art pieces, making them more accessible to a wider audience.

Applications in Gaming

Digital assets are revolutionizing the gaming industry. In-game items, virtual land, and digital characters can be traded and owned by players. This creates a dynamic marketplace within the game, offering new ways to monetize and interact. The ability to directly interact with and own in-game assets can lead to greater player engagement and loyalty. For example, in-game virtual land can be used to create unique experiences for players.

Applications in Other Industries

Beyond finance, art, and gaming, digital assets are finding applications in various sectors. Supply chain management benefits from digital asset tracking, ensuring product authenticity and transparency. Identity management systems can use digital credentials to enhance security and efficiency. Healthcare can leverage digital assets to manage patient records and medical data.

Table of Digital Asset Use Cases

| Industry | Use Case | Example | Benefits | Drawbacks |

|---|---|---|---|---|

| Finance | Cross-border payments | Using stablecoins for international transactions | Reduced transaction costs, faster processing | Volatility of cryptocurrencies, regulatory uncertainties |

| Art | Digital art ownership | Buying and selling NFTs representing artwork | Direct artist-collector interaction, fractional ownership | Lack of widespread acceptance, potential for scams |

| Gaming | In-game item trading | Trading virtual characters and equipment | Increased player engagement, new monetization models | Potential for exploitation, balancing in-game economies |

| Supply Chain | Product tracking | Using blockchain to verify product origin and authenticity | Increased transparency, reduced counterfeiting | Integration challenges, cost of implementation |

Final Review

In conclusion, digital assets represent a significant shift in how value is created, exchanged, and stored. While presenting exciting possibilities, they also introduce complexities related to valuation, security, and regulation. The future of digital assets hinges on continued innovation, responsible development, and robust regulatory frameworks. This comprehensive overview equips readers with a foundational understanding of this rapidly evolving sector.

Questions and Answers

What are the different types of digital assets?

Digital assets encompass various forms, including cryptocurrencies (like Bitcoin and Ethereum), Non-Fungible Tokens (NFTs), digital art, and in-game items. Each type has unique characteristics and use cases.

How are digital assets valued?

Valuation methods for digital assets vary depending on the asset type. Market price, scarcity, and utility are crucial factors. Cryptocurrencies are often valued by their trading volume and market capitalization, while NFTs are priced based on factors like artist reputation, demand, and the artwork’s perceived value.

What are the major security risks associated with digital assets?

Security risks include hacking, phishing, and scams. Safeguarding digital assets requires strong passwords, two-factor authentication, and regular security audits.

What is the role of blockchain technology in the digital asset ecosystem?

Blockchain technology underpins many digital assets, providing transparency, security, and immutability to transactions. It enables secure and verifiable records of ownership and transactions.