Decentralized finance (DeFi) is changing how we think about money. Imagine a financial system without banks, run by code and trustless agreements. This innovative approach offers exciting possibilities, but also presents unique challenges. We’ll explore how DeFi works, its potential benefits, the risks involved, and where it might be headed in the future.

DeFi leverages blockchain technology to create financial services without intermediaries. This means users can access lending, borrowing, trading, and other financial products directly, cutting out traditional middlemen. However, it’s crucial to understand the underlying mechanisms and potential vulnerabilities.

Introduction to Decentralized Finance (DeFi)

Decentralized Finance (DeFi) is a revolutionary approach to financial services that leverages blockchain technology to bypass traditional intermediaries like banks and financial institutions. This technology aims to create a more transparent, accessible, and potentially more efficient financial system. DeFi protocols operate on a shared, immutable ledger, reducing reliance on central authorities and fostering trust through cryptography.DeFi aims to democratize access to financial services by enabling peer-to-peer transactions and automated processes.

It offers opportunities for individuals to participate in financial markets without the limitations or costs often associated with traditional finance. However, it also presents risks and challenges, including security vulnerabilities and regulatory uncertainties.

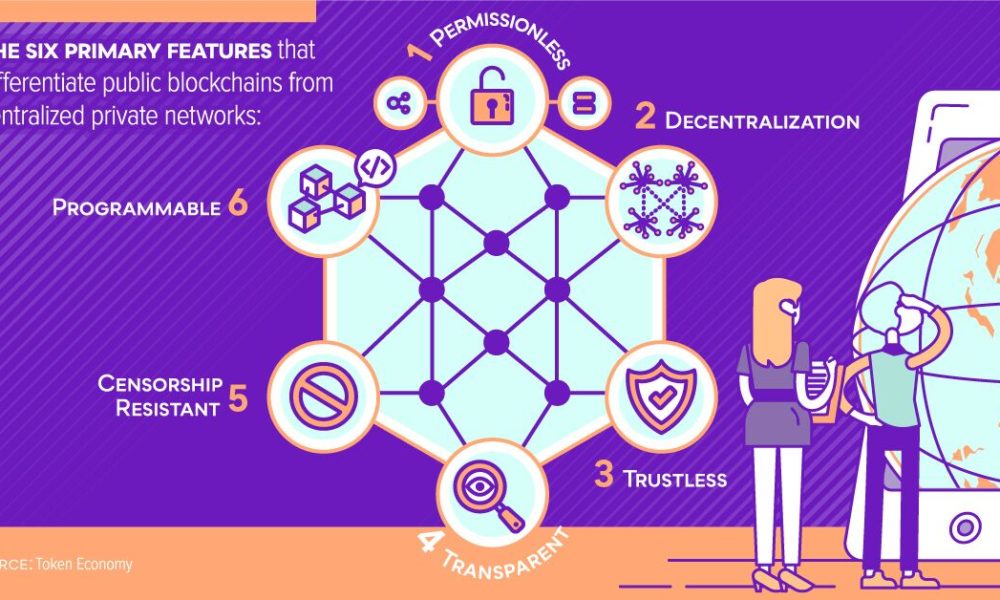

Core Principles of DeFi

DeFi operates on the core principles of decentralization, transparency, and automation. Decentralization means that no single entity controls the system. Transparency ensures that all transactions are visible on the blockchain. Automation allows for the execution of financial contracts and processes without human intervention. These principles underpin the creation of various DeFi applications, such as lending, borrowing, trading, and insurance.

Key Differences between DeFi and Traditional Finance

Traditional finance relies on centralized institutions like banks and credit card companies, while DeFi utilizes blockchain technology to remove the need for intermediaries. This difference results in various distinctions. DeFi transactions are typically faster and more accessible, but they also come with different security and regulatory frameworks. Traditional finance often involves complex procedures and stringent regulations, whereas DeFi relies on cryptographic security and smart contracts.

Security and regulatory frameworks differ greatly between DeFi and traditional finance.

Historical Context of DeFi’s Emergence

DeFi’s rise can be traced back to the development of cryptocurrencies, particularly Bitcoin. The inherent decentralization of blockchain technology provided the foundation for DeFi protocols. The subsequent emergence of Ethereum, with its smart contract capabilities, further accelerated DeFi’s growth. Early experiments with decentralized lending and borrowing platforms laid the groundwork for the more sophisticated and widely used protocols currently available.

Decentralized finance (DeFi) is changing how we think about money, but its real-world application is still evolving. One area where DeFi could potentially intersect is with contactless payments, like those found in Contactless payments. Imagine a future where DeFi platforms handle the underlying transactions for these payments, making them even faster and more secure. This could lead to a more streamlined and efficient financial system overall.

Popular DeFi Protocols and Their Functionalities

Several popular DeFi protocols have emerged, each with unique functionalities. A few examples include Compound, Aave, and Uniswap. Compound and Aave are decentralized lending platforms, allowing users to lend and borrow cryptocurrencies. Uniswap is a decentralized exchange (DEX) facilitating the trading of cryptocurrencies without a central order book. These examples illustrate the diversity of applications within the DeFi ecosystem.

Comparison of DeFi and Traditional Financial Institutions

| Feature | DeFi | Traditional Financial Institutions |

|---|---|---|

| Role | Facilitates peer-to-peer financial transactions, automated processes, and access to financial services. | Acts as intermediaries for financial transactions, managing deposits, loans, and investments. |

| Security Measures | Relies on cryptography and smart contracts for security. | Employs a combination of physical and digital security measures, including fraud detection and regulatory compliance. |

| User Experience | Often involves a learning curve due to the technical nature of blockchain technology. | Generally has a more established user experience with familiar interfaces. |

| Accessibility | Potentially more accessible to users globally. | Often has geographical limitations and barriers to entry. |

Core Components of DeFi

Decentralized finance (DeFi) is built on a foundation of interconnected components, each playing a crucial role in its functionality and potential. These components are designed to operate without intermediaries, promoting transparency and accessibility. From smart contracts automating transactions to decentralized exchanges facilitating trading, DeFi offers a unique alternative to traditional financial systems.The core components of DeFi work together to create a robust and innovative financial ecosystem.

This includes mechanisms for lending and borrowing, trading, and stablecoin creation, all powered by blockchain technology. This allows for greater financial inclusion and opportunities for users, but also introduces risks that users need to be aware of.

Smart Contracts

Smart contracts are self-executing contracts with the terms of the agreement between buyer and seller being directly written into lines of code. They automate the execution of agreements, eliminating the need for intermediaries. This automation reduces transaction costs and speeds up processes. Security is paramount in smart contracts; vulnerabilities can have severe consequences. For example, the DAO hack in 2016 highlighted the importance of thorough code audits and security testing.

Decentralized finance (DeFi) is changing how we think about financial transactions. One key area where DeFi is making a big impact is in the use of payment gateways. These gateways are crucial for enabling secure and efficient transactions within the DeFi ecosystem, and are essential for the future of decentralized finance. The use of Payment gateways is rapidly expanding the DeFi market, and will likely play an even larger role in its development.

Decentralized Exchanges (DEXs)

DEXs are digital marketplaces for trading cryptocurrencies that operate without a central authority. These platforms utilize smart contracts to execute trades directly between users, eliminating the need for intermediaries like traditional exchanges. DEXs often prioritize security and transparency over speed. This allows for greater control over trading activities, and user assets are not held by a central authority, making them attractive to many users.

Lending and Borrowing Protocols

Lending and borrowing protocols allow users to lend and borrow cryptocurrencies and other assets. These platforms often use collateralized lending to manage risk, and users can earn interest on their deposits. Protocols frequently employ algorithms to manage liquidity and interest rates, optimizing efficiency. For example, Aave and Compound are prominent lending platforms that operate on this principle.

Decentralized finance (DeFi) is all about cutting out the middleman in financial transactions. This often overlaps with peer-to-peer (P2P) payments, Peer-to-peer (P2P) payments which are direct exchanges between individuals, and this can lead to more efficient and potentially cheaper solutions. Ultimately, DeFi aims to create a more transparent and accessible financial system for everyone.

Stablecoins and Other Cryptocurrencies

Stablecoins are cryptocurrencies designed to maintain a stable value relative to fiat currencies, like the US dollar. They are a key component of DeFi, providing a stable store of value. Other cryptocurrencies, like Bitcoin, are also vital, serving as underlying assets for various DeFi protocols. Stablecoins enable more stable transactions and reduce the volatility associated with other cryptocurrencies.

Table of DeFi Protocols

| Protocol Type | Function | Risks |

|---|---|---|

| Decentralized Exchange (DEX) | Facilitates peer-to-peer cryptocurrency trading | Smart contract vulnerabilities, impermanent loss, liquidity risk |

| Lending and Borrowing Protocol | Enables lending and borrowing of crypto assets | Impermanent loss, liquidation risk, interest rate risk, security vulnerabilities |

| Yield Farming Protocol | Provides opportunities to earn interest on deposited crypto assets | Impermanent loss, security vulnerabilities, market risk |

| Stablecoin Protocol | Issues stablecoins pegged to fiat currencies | Reliance on collateral, potential for collateral manipulation, smart contract vulnerabilities |

| Derivatives Protocol | Enables trading of derivatives contracts on crypto assets | Market risk, liquidation risk, security vulnerabilities, leverage risk |

DeFi Use Cases and Applications: Decentralized Finance (DeFi)

Decentralized finance (DeFi) is rapidly expanding its reach across various sectors, offering innovative solutions to traditional financial problems. This section explores diverse applications of DeFi, from personal finance to global commerce, highlighting its potential for financial inclusion and broader accessibility.

DeFi in Personal Finance and Investment

DeFi platforms are transforming personal finance and investment strategies by offering a range of options beyond traditional banking and brokerage services. Users can leverage decentralized exchanges (DEXs) for trading cryptocurrencies and other assets, often with lower fees and greater transparency than centralized platforms. Automated market makers (AMMs) facilitate liquidity provision and trading with algorithms, allowing for dynamic price discovery.

Savings accounts and lending protocols allow users to earn interest on crypto or fiat assets, while borrowing funds for various purposes. These functionalities provide individuals with more control and potentially higher returns on their investments.

DeFi for Financial Inclusion and Access

DeFi has the potential to revolutionize financial inclusion by providing access to financial services to underserved populations. Individuals in regions with limited or no access to traditional banking can use DeFi platforms to send and receive money, borrow and lend, and engage in other financial activities. This democratization of finance can empower individuals and communities by enabling greater economic participation and opportunity.

DeFi and Cross-Border Transactions

DeFi’s decentralized nature facilitates cross-border transactions with greater speed and lower costs than traditional methods. Transactions are processed on blockchain networks without intermediaries, potentially reducing transaction fees and clearing times. This can be especially beneficial for international trade and remittances, connecting individuals and businesses across geographical boundaries.

DeFi in Supply Chain Finance

DeFi applications can streamline supply chain finance by automating and digitizing various processes. Smart contracts can automate payments and track goods throughout the supply chain, enhancing transparency and reducing risks. This can improve efficiency, reduce costs, and increase trust among participants in the supply chain. DeFi can facilitate faster and more secure payments, and potentially create new financing opportunities for businesses.

Table of DeFi Applications and Benefits

| DeFi Application | Benefits | Specific Examples |

|---|---|---|

| Personal Finance | Lower fees, greater transparency, diverse investment options, higher potential returns | Using a DEX for cryptocurrency trading, earning interest on stablecoins, borrowing funds through a DeFi protocol. |

| Financial Inclusion | Access to financial services for underserved populations, particularly in developing countries | Providing microloans to entrepreneurs through a decentralized lending platform, enabling peer-to-peer payments in areas without traditional banking infrastructure. |

| Cross-Border Transactions | Faster and cheaper cross-border transactions, reduced reliance on intermediaries | Facilitating remittances to family members abroad using a cross-border DeFi platform, enabling faster payments for international trade. |

| Supply Chain Finance | Streamlined processes, improved transparency, reduced risks, potentially lower costs | Automating payments for goods in transit using smart contracts, tracking inventory and ensuring secure payment processes, providing financing for businesses based on supply chain data. |

Security and Risks in DeFi

Decentralized finance (DeFi) offers exciting opportunities, but it’s also fraught with security risks. Smart contracts, the backbone of many DeFi protocols, are vulnerable to exploits if not meticulously coded and audited. Understanding these vulnerabilities is crucial for anyone engaging with DeFi, as these risks can lead to significant financial losses.

Potential Vulnerabilities and Security Threats

DeFi systems, while aiming for transparency and decentralization, are susceptible to various attacks. These attacks can exploit vulnerabilities in the smart contracts that underpin these systems. Improper coding practices, or even subtle bugs, can lead to significant financial losses for users. Furthermore, the decentralized nature of DeFi can make it difficult to trace and address these attacks.

The anonymity inherent in some DeFi platforms can also obscure the origin of malicious activity.

Smart Contract Exploits and Hacks

Smart contract exploits represent a significant threat to DeFi users. These exploits often involve vulnerabilities that allow attackers to manipulate the code, gaining unauthorized access to funds or tokens. For instance, a reentrancy vulnerability in a smart contract can allow attackers to repeatedly call the contract, draining the funds intended for legitimate users. Another common exploit involves manipulating the contract’s logic, forcing it to execute unwanted transactions.

Security Audits and Bug Bounties

Security audits are crucial for identifying vulnerabilities in smart contracts before they are exploited. These audits, conducted by specialized firms, rigorously examine the code for potential flaws. Bug bounty programs are another effective strategy. These programs incentivize security researchers to identify and report vulnerabilities, fostering a collaborative approach to security. These programs are increasingly important in the DeFi space.

Regulatory Frameworks and Compliance

The lack of a unified regulatory framework for DeFi presents a significant challenge. Different jurisdictions have varying approaches to regulating cryptocurrencies and DeFi protocols. This lack of clear guidelines can hinder the development of robust security measures and create uncertainties for investors. The need for regulatory clarity and compliance standards is critical for the long-term health and sustainability of DeFi.

Comparison of Security Measures

Different DeFi protocols employ various security measures. Some protocols leverage multi-signature wallets to enhance security by requiring multiple parties to approve transactions. Others utilize advanced cryptography techniques to protect user data and transactions. The choice of security measures often depends on the specific protocol and its intended use case. Each method has trade-offs in terms of complexity and effectiveness.

Common DeFi Security Risks and Mitigation Strategies

| Security Risk | Mitigation Strategy |

|---|---|

| Smart contract vulnerabilities | Rigorous security audits, bug bounty programs, and code reviews |

| Exploits and hacks | Enhanced security protocols, secure coding practices, and continuous monitoring |

| Lack of regulatory frameworks | Development of clear and consistent regulatory frameworks |

| Human error | Security awareness training for developers and users |

| External factors (e.g., market manipulation, price volatility) | Diversification of investments, risk management strategies |

Future of DeFi

The decentralized finance (DeFi) ecosystem is rapidly evolving, with new protocols and applications emerging constantly. Predicting the future of DeFi is challenging, but analyzing current trends and potential disruptions allows for a more informed perspective. This section explores the potential trajectory of DeFi, the influence of emerging technologies, regulatory considerations, and the transformative impact on financial systems.The future of DeFi is intertwined with technological advancements, regulatory clarity, and the adoption rate of various protocols.

It’s not simply a linear progression but a dynamic interplay of these factors, making accurate predictions complex. However, by examining current trends and potential challenges, a more nuanced understanding of the DeFi landscape can be formed.

Potential Trajectory of DeFi

DeFi’s trajectory is expected to be characterized by both rapid growth and challenges. The initial burst of innovation is likely to settle into a more structured and regulated environment. This could lead to more sophisticated and secure protocols, along with increased institutional adoption. However, ongoing challenges, such as security vulnerabilities, regulatory uncertainty, and the need for user education, will continue to influence its development.

Impact of Emerging Technologies

Emerging technologies like artificial intelligence (AI) and blockchain scalability solutions will significantly impact DeFi. AI can enhance automated trading strategies, risk management, and customer service within DeFi platforms. Scalability solutions like layer-2 protocols will address transaction speed and cost issues, making DeFi more accessible and practical for wider use. The combination of these technologies promises to significantly improve the efficiency and usability of DeFi applications.

Role of Regulations and Policies

Regulatory frameworks are crucial for the sustainable growth of DeFi. Clear guidelines on tokenization, lending, and stablecoins will foster trust and reduce risks. A balanced approach that promotes innovation while mitigating potential harm is essential. International cooperation on regulatory standards will be vital to avoid fragmentation and foster global adoption.

Revolutionizing Financial Systems, Decentralized finance (DeFi)

DeFi has the potential to revolutionize financial systems by providing access to financial services for underserved populations. By reducing reliance on intermediaries, DeFi can create more transparent and efficient financial systems. This accessibility can lead to more inclusive and equitable financial landscapes, although potential risks must be carefully considered.

Comparison of Predictions

Different analysts and commentators have diverse predictions regarding the future of DeFi. Some foresee widespread adoption and integration into mainstream finance, while others highlight potential regulatory headwinds and security vulnerabilities. The diverse predictions underscore the complexity of the landscape and the need for a nuanced approach to understanding its evolution. For instance, some predict a surge in institutional adoption, while others anticipate a more cautious approach by traditional financial institutions.

Projected Growth and Adoption Rates

| DeFi Protocol | Projected Growth Rate (2024-2028) | Projected Adoption Rate (2024-2028) |

|---|---|---|

| Aave | 15-20% | 30-40% |

| Compound | 10-15% | 25-35% |

| Uniswap | 12-18% | 20-30% |

| Synthetix | 8-12% | 15-25% |

| Balancer | 10-15% | 20-30% |

This table presents projected growth and adoption rates for several prominent DeFi protocols. These figures are estimations based on current market trends and expert opinions. Actual outcomes may vary.

DeFi and Regulation

The explosive growth of Decentralized Finance (DeFi) has brought significant attention to its regulatory implications. The decentralized nature of DeFi, operating outside traditional financial frameworks, poses unique challenges for regulators worldwide. Finding a balance between fostering innovation and ensuring investor protection is a crucial task.

Current Regulatory Landscape

The regulatory landscape surrounding DeFi is still evolving and fragmented. Many jurisdictions are taking a cautious approach, often applying existing financial regulations to DeFi protocols and activities. This approach can lead to uncertainty, as applying traditional regulations to decentralized systems may not fully capture the nuances of DeFi operations. This evolving nature necessitates a careful approach to ensure the regulatory framework keeps pace with the innovation.

Challenges of Regulating Decentralized Systems

Regulating decentralized systems presents significant challenges. The decentralized nature of DeFi protocols makes it difficult to identify and hold accountable specific entities. Jurisdictional boundaries are often blurred, with transactions and protocols potentially spanning multiple jurisdictions, adding complexity to regulatory oversight. Moreover, the rapid pace of innovation in DeFi often outpaces the ability of regulators to adapt and develop appropriate regulations.

This creates a constant tension between supporting technological advancement and maintaining financial stability.

Different Regulatory Approaches Across Jurisdictions

Different jurisdictions are adopting varying approaches to regulating DeFi. Some countries are focusing on specific DeFi activities, such as stablecoins or lending protocols, while others are taking a broader, more encompassing approach to the entire ecosystem. The approaches reflect a spectrum of regulatory frameworks, from a hands-off approach to more stringent oversight. This varied approach makes it difficult to compare effectiveness across different jurisdictions.

Decentralized finance (DeFi) is a fascinating area of digital finance, offering a new way to access financial services. It leverages blockchain technology to create transparent and permissionless financial systems. This aligns perfectly with the broader concept of Digital finance , which encompasses all digital financial innovations. Ultimately, DeFi aims to improve accessibility and efficiency in the financial world.

Examples of Successful Regulatory Frameworks Related to DeFi

While concrete examples of successful regulatory frameworks specifically tailored to DeFi are still emerging, some jurisdictions are demonstrating promising steps in this area. For instance, some jurisdictions have established regulatory sandboxes or pilot programs to allow for experimentation with DeFi technologies under controlled conditions. These initiatives provide a valuable opportunity for regulators to gather data and experience, and adjust regulatory frameworks as needed.

This iterative process is crucial for ensuring effective regulation in a rapidly evolving space.

Table Demonstrating Varying Regulatory Approaches to DeFi Globally

| Jurisdiction | Regulatory Approach | Specific Focus | Challenges |

|---|---|---|---|

| United States | Applying existing securities laws | Classifying tokens as securities, focusing on KYC/AML | Difficulties in applying existing laws to decentralized protocols, evolving regulatory interpretations |

| European Union | MiCA (Markets in Crypto Assets Regulation) | Establishing a comprehensive regulatory framework for crypto assets | Balancing innovation with investor protection in the complex DeFi landscape |

| Singapore | Promoting innovation while ensuring regulatory oversight | Licensing and registration requirements, focus on stablecoins | Balancing encouragement of innovation with protection against financial risks |

| Japan | Gradual regulatory approach | Applying existing financial regulations, KYC/AML compliance | Balancing the need for clarity and stability with the evolving nature of DeFi |

This table provides a glimpse into the diverse regulatory strategies adopted globally. Each jurisdiction faces unique challenges in addressing the complexities of DeFi, necessitating a nuanced and flexible approach to regulation. Further development and adaptation will be crucial as DeFi continues to evolve.

DeFi and the Environment

Decentralized finance (DeFi) is rapidly growing, but its environmental impact is a crucial consideration. The energy consumption of blockchain networks, particularly proof-of-work (PoW) blockchains like Bitcoin, has drawn significant attention. This section explores the environmental implications of DeFi, examining the energy use of different protocols and potential solutions for a more sustainable future.The energy consumption of blockchain technology, a fundamental aspect of DeFi, is a subject of ongoing debate.

While proponents emphasize the security and transparency offered by blockchain, critics highlight the potential environmental consequences. This raises the question of how to balance innovation with environmental responsibility in the DeFi space.

Energy Consumption of Different DeFi Protocols

The energy consumption of DeFi protocols varies significantly depending on the underlying blockchain technology. Proof-of-work blockchains, like Ethereum’s (formerly) PoW-based network, are known for their substantial energy requirements, whereas proof-of-stake blockchains are generally more energy-efficient. The energy consumed by a protocol directly influences its environmental footprint.

DeFi is changing how we think about finance, and it’s interesting to see how it might intersect with everyday things like point-of-sale (POS) systems. Point-of-sale (POS) systems could potentially benefit from DeFi’s transparent and secure nature, leading to more efficient and trustworthy transactions. Ultimately, this kind of innovation is a big step forward for decentralized finance.

Potential Solutions to Reduce the Environmental Footprint

Several strategies can help mitigate the environmental impact of DeFi. Transitioning to more energy-efficient consensus mechanisms, like proof-of-stake (PoS), is a key step. Furthermore, improving the efficiency of transaction processing and reducing the number of unnecessary transactions can significantly reduce energy consumption. Supporting and promoting the development of sustainable blockchain technologies is also crucial.

Examples of DeFi Projects Focusing on Sustainability

Some DeFi projects are actively working towards reducing their environmental footprint. These projects are exploring various approaches, such as using renewable energy sources for their operations or implementing more energy-efficient consensus mechanisms. These initiatives show that sustainable practices are becoming increasingly important in the DeFi ecosystem. For example, some projects are exploring the use of carbon offsetting mechanisms to neutralize their environmental impact.

Table Comparing Energy Consumption of DeFi Protocols

| DeFi Protocol | Consensus Mechanism | Estimated Energy Consumption (per transaction) | Environmental Impact |

|---|---|---|---|

| Ethereum (pre-Merge) | Proof-of-Work | High | High carbon emissions |

| Ethereum (post-Merge) | Proof-of-Stake | Low | Low carbon emissions |

| Solana | Proof-of-History | Very Low | Very low carbon emissions |

| Cardano | Proof-of-Stake | Low | Low carbon emissions |

Note: Energy consumption estimates are approximations and can vary depending on factors like network congestion.

Summary

Source: visualcapitalist.com

In conclusion, Decentralized Finance (DeFi) represents a fascinating evolution in the financial world. While it offers exciting opportunities for financial inclusion and innovation, users must understand the complexities and risks. The future of DeFi is tied to its ability to adapt to regulatory changes, address security concerns, and maintain user trust.

Commonly Asked Questions

What are some of the main risks associated with DeFi?

Smart contract vulnerabilities, hacks, and security exploits are major risks. Additionally, the lack of regulation and centralized oversight in DeFi can create uncertainty.

How does DeFi differ from traditional finance?

DeFi operates on decentralized platforms, using blockchain technology, rather than traditional financial institutions. This eliminates reliance on intermediaries and central authorities. Security measures and user experience are also quite different.

What are some examples of DeFi protocols?

A few popular examples include Compound, Aave, and Uniswap. These protocols offer various financial services, like lending, borrowing, and trading cryptocurrencies.