Algorithmic trading is revolutionizing financial markets. It uses computer programs to execute trades automatically, often at lightning speed, based on complex sets of rules. This differs significantly from traditional methods, where humans make decisions. Understanding the inner workings of these systems, from the data they rely on to the risks they face, is crucial for navigating the modern financial landscape.

This overview explores the principles, strategies, and considerations surrounding algorithmic trading, including the role of data, the development of strategies, risk management, technology, regulations, ethical implications, and future trends. We’ll break down how algorithms make trading decisions and how they interact with the financial markets.

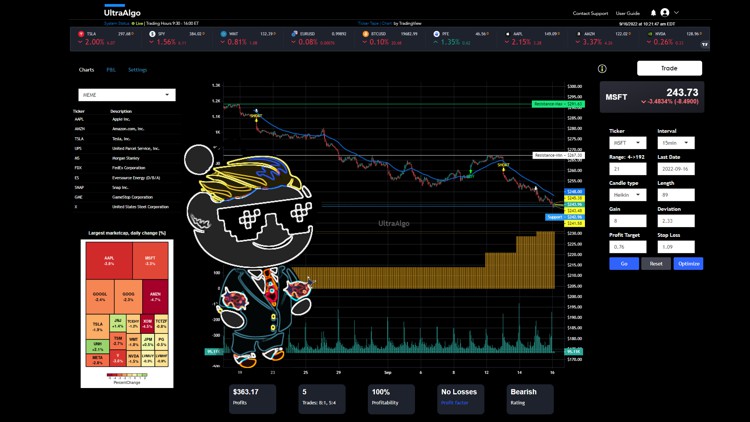

Introduction to Algorithmic Trading

Source: studybullet.com

Algorithmic trading, also known as automated trading, is a method of executing trades using pre-programmed instructions. These instructions, or algorithms, are designed to react to market conditions and execute trades in a way that might not be possible for a human trader. This differs significantly from traditional trading, where decisions are made by humans based on their own analysis and judgment.This automated approach offers several advantages, such as speed, consistency, and the ability to process vast amounts of data in a fraction of a second.

However, it also comes with risks, as algorithms can react in unforeseen ways to unexpected market events. Understanding the nuances of algorithmic trading is crucial for investors looking to incorporate this approach into their strategies.

Algorithmic Trading Strategies

Various strategies exist within algorithmic trading, each with its own set of rules and objectives. These strategies aim to capitalize on different market conditions and opportunities.

| Strategy Type | Description | Key Characteristics |

|---|---|---|

| High-Frequency Trading (HFT) | HFT involves the rapid execution of numerous trades, often within milliseconds, to capitalize on small price fluctuations. | Extremely fast execution speed, reliance on sophisticated algorithms, and sophisticated infrastructure for low latency. |

| Arbitrage | Arbitrage seeks to exploit price discrepancies between different markets or exchanges for the same asset. This typically involves simultaneously buying in one market and selling in another. | Identifying and exploiting price discrepancies, typically across multiple exchanges, using sophisticated algorithms to track market conditions in real-time. |

| Trend Following | Trend-following algorithms seek to identify and capitalize on established market trends. | Identify and follow trends in price movements, using indicators and statistical analysis to generate buy and sell signals. Often relies on historical data to forecast future price movements. |

| Mean Reversion | Mean reversion strategies assume that prices will eventually return to their historical average. | Based on the assumption that price fluctuations are temporary and will revert to a long-term average, these strategies involve buying when prices are depressed and selling when they are elevated. |

Key Components of an Algorithmic Trading System

A robust algorithmic trading system typically comprises several interconnected components.

- Data Feed: Real-time market data is essential for triggering trades based on market conditions. This data might include prices, volume, and order books. The data feed’s reliability and speed are crucial for the system’s effectiveness.

- Algorithm: The core of the system, this algorithm defines the trading rules and strategies. It interprets market data and generates buy/sell signals.

- Execution Engine: This engine executes the orders generated by the algorithm. It interacts with trading platforms to ensure that orders are placed efficiently and at the desired prices.

- Risk Management System: This component monitors and controls the system’s exposure to market risk. It sets limits on positions and defines stop-loss orders to mitigate potential losses.

The Role of Data in Algorithmic Trading

Data is the lifeblood of algorithmic trading. Without accurate, timely, and relevant data, sophisticated algorithms are simply tools without fuel. This crucial element underpins every aspect of the process, from strategy development to execution. A robust understanding of data sources, types, and preprocessing techniques is paramount for success in this field.Data is the cornerstone of effective algorithmic trading strategies.

Different strategies require different types of data, and the quality and availability of this data significantly impact the performance of these strategies. From market prices and order flow to fundamental data and economic indicators, the appropriate data informs the model, ultimately influencing trading decisions.

Data Sources in Algorithmic Trading

A multitude of data sources provide the raw material for algorithmic trading strategies. These sources range from readily available public data to proprietary and specialized feeds. Understanding these sources is essential for effective strategy design.

- Market Data Feeds: These feeds provide real-time information on market prices, order books, and trading volume. This data is crucial for high-frequency trading strategies, as well as those that react to rapid market changes. Examples include tick data, level 2 quotes, and trade confirmations.

- Fundamental Data Providers: These sources offer data on company financials, economic indicators, and other relevant information that can be used to assess the intrinsic value of assets. Companies like Bloomberg and FactSet are prominent examples.

- News and Sentiment Data: News articles, social media sentiment, and other forms of news provide valuable insights into market sentiment and potential catalysts for price movements. This type of data can be leveraged to predict market direction, but requires careful analysis and filtering to avoid noise.

- Economic Data: Information on GDP growth, inflation rates, interest rates, and other economic indicators can provide context for market trends and help anticipate potential shifts. Government agencies and specialized economic research organizations often provide this data.

Data Types Used in Algorithmic Trading

Different data types are used for different purposes. Understanding these types is essential for selecting the correct data for a particular strategy.

Algorithmic trading is all about using computer programs to make trades automatically. It’s becoming increasingly popular, especially when it comes to the fast-paced world of Decentralized finance (DeFi). Decentralized finance (DeFi) offers unique opportunities for automated strategies, and algorithmic trading plays a significant role in this evolving landscape. This automation can also improve the speed and efficiency of trading in this space.

- Time Series Data: This data, like historical stock prices or market indices, is crucial for identifying patterns and trends in market behavior. It is often used for developing technical indicators and backtesting strategies.

- Categorical Data: This data, such as industry classifications or news sentiment, can help to categorize stocks or markets. This data type aids in forming more specific trading rules.

- Numerical Data: This includes financial ratios, company valuations, and other quantitative information that can be used to analyze the financial health of companies and predict future performance. This data is frequently used in fundamental analysis.

Data Preprocessing and Analysis in Algorithmic Trading

Raw data is rarely usable directly. Data preprocessing and analysis are essential steps in transforming raw data into usable information for algorithmic trading.

- Data Cleaning: Raw data often contains errors, missing values, and inconsistencies. Cleaning this data ensures accuracy and reliability in the subsequent analysis.

- Feature Engineering: Extracting meaningful features from the data is crucial for building effective trading strategies. This might involve calculating technical indicators or creating new variables based on existing data.

- Data Transformation: This process involves converting the data into a suitable format for analysis. For example, normalization can be used to scale data for better model performance.

- Data Visualization: Visualizing the data helps in identifying patterns, trends, and anomalies that might not be apparent in raw data. This is crucial for gaining insights and making informed decisions.

Examples of Data Sets Used in Different Algorithmic Trading Strategies

- High-Frequency Trading (HFT): HFT strategies often use market data feeds (tick data, order book data) to react to rapid price changes. These data sets capture market microstructure information, allowing algorithms to react to minute changes in market conditions.

- Fundamental Analysis: Strategies relying on fundamental analysis use financial statement data (balance sheets, income statements) to evaluate company performance and predict future stock prices. These data sets are often obtained from financial databases or directly from company filings.

- Technical Analysis: Strategies using technical analysis leverage historical price and volume data to identify patterns and trends in market behavior. Data sets include historical stock prices, trading volume, and various technical indicators.

Data Sources and Applications in Algorithmic Trading

| Data Source | Application in Algorithmic Trading |

|---|---|

| Market Data Feeds | High-frequency trading, order book analysis, market microstructure analysis |

| Fundamental Data Providers | Fundamental analysis, company valuation, risk assessment |

| News and Sentiment Data | Sentiment analysis, market sentiment prediction, event-driven trading |

| Economic Data | Macroeconomic analysis, market trend prediction, risk management |

Developing Algorithmic Trading Strategies

Crafting effective algorithmic trading strategies hinges on a methodical approach, combining market analysis, technical expertise, and rigorous testing. This involves translating market insights into a series of instructions for automated trading, ensuring the strategy aligns with the trader’s risk tolerance and financial goals. Careful consideration must be given to the potential for unexpected market movements and the need for robust risk management protocols.The design and implementation of a trading algorithm is a multifaceted process that requires a blend of technical skills and market understanding.

Successful algorithms are not simply formulas; they are dynamic systems that adapt to changing market conditions, incorporating feedback from backtesting and adjustments based on performance metrics. This dynamic nature necessitates continuous monitoring and refinement to maintain effectiveness.

Designing Trading Strategies

Developing a trading strategy involves a series of steps, from initial idea generation to final deployment. Key components include defining the target market, identifying specific trading patterns, and selecting suitable indicators.

- Market Analysis: Understanding market trends, volatility, and sentiment is crucial for identifying profitable opportunities. This requires a deep dive into historical price data, news events, and economic indicators. Fundamental analysis, focusing on company financials and industry trends, may be combined with technical analysis, evaluating chart patterns and indicators like moving averages.

- Strategy Formulation: The specific rules and logic governing the trading algorithm must be Artikeld precisely. Defining entry and exit points, position sizing, and stop-loss thresholds is critical. For example, a trend-following strategy might use a moving average crossover to signal buy or sell orders.

- Risk Management: Incorporating risk management strategies is vital. These strategies might include setting stop-loss orders, limiting position size, and diversifying across various markets or asset classes. A strategy that fails to account for potential losses is inherently flawed.

Strategy Types

Different types of strategies address diverse market opportunities.

- Market Making: This strategy involves providing liquidity by simultaneously quoting both buy and sell prices for an asset. Profit is generated from the bid-ask spread. This strategy relies heavily on accurate price prediction and the ability to quickly adjust quotes based on market demand.

- Arbitrage: Exploiting price discrepancies across different markets or exchanges allows for risk-free profits. For example, if the same stock is trading at a lower price on one exchange compared to another, an arbitrage strategy would buy on the lower exchange and sell on the higher exchange. The profit margin depends on the size of the price difference and transaction costs.

- Trend Following: These strategies aim to capitalize on prevailing market trends by identifying and following price movements. They often use technical indicators like moving averages, volume, and momentum to signal entry and exit points. However, trend reversals can lead to significant losses if not anticipated properly.

Backtesting and Validation

Backtesting is essential for evaluating a strategy’s performance under various market conditions. Validating the strategy is crucial to ensure its robustness and suitability for live trading.

- Backtesting: This involves running the algorithm on historical data to simulate trading outcomes. Backtesting helps identify potential issues, such as high drawdowns or inconsistent profitability. Carefully choosing the appropriate historical data, considering market conditions and their impact on the trading strategy, is essential.

- Validation: This stage involves examining the results of the backtesting and comparing them to realistic market conditions. This includes assessing the strategy’s profitability, risk, and consistency over various market cycles. Comparing results against a benchmark or a known market index is a helpful validation step.

Flowchart for Trading Strategy Development

The following flowchart illustrates the process involved in building and testing a trading strategy.“`[A flowchart image would be shown here. The flowchart would visually depict the steps:

- Strategy Idea Generation,

- Data Collection,

- Strategy Design,

- Backtesting,

- Validation,

- Optimization,

- Deployment,

- Monitoring & Adjustment. Each step would have connecting arrows indicating the flow.]

“`

Basic Algorithmic Trading Strategy

Implementing a basic algorithmic trading strategy involves the following steps:

- Hypothetical Platform Setup: Using a hypothetical platform (e.g., a simulated trading environment), set up accounts and specify the asset for trading. This might involve setting up a virtual brokerage account.

- Strategy Coding: Translate the trading logic into code, defining the entry and exit rules. This step involves programming language knowledge (e.g., Python, C++). A simplified example could involve buying a stock when its price crosses a moving average.

- Testing & Refinement: Thoroughly test the strategy on historical data and refine the code based on performance metrics. Adjusting parameters, like stop-loss thresholds, is important.

- Deployment: Once the strategy is validated, deploy it to the trading platform. This often involves connecting the algorithmic code to the platform’s API.

Risk Management in Algorithmic Trading

Algorithmic trading, while offering potential for high returns, inherently carries risks. Effective risk management is crucial for mitigating these risks and ensuring the longevity of a trading strategy. A well-defined risk management framework acts as a safety net, protecting capital and preventing catastrophic losses. It’s not just about avoiding losses; it’s about setting clear parameters for acceptable risk within the trading process.Risk management in algorithmic trading isn’t a one-time setup; it’s an ongoing process.

It requires constant monitoring, adaptation, and adjustments to changing market conditions and evolving trading strategies. Successful algorithmic traders understand that risk management is not a separate entity but an integral part of every trading decision.

Critical Role of Risk Management

Risk management in algorithmic trading ensures that potential losses are capped, and that the trading system does not expose the trader to excessive risk. This is achieved by setting clear limits on the amount of capital at risk on any single trade or group of trades. Robust risk management protects capital and enables consistent profitability over the long term.

Risk Management Techniques, Algorithmic trading

A comprehensive risk management strategy incorporates several key techniques. These techniques are not mutually exclusive and often work in conjunction to provide a more holistic approach to managing risk.

Stop-Loss Orders

Stop-loss orders are predefined instructions to sell a security when it reaches a certain price. This helps limit potential losses if the market moves against the trader’s position. By setting a predetermined price level, traders can automatically exit a trade before significant losses occur. For example, if a trader buys a stock at $50 and sets a stop-loss order at $45, they will automatically sell the stock if it falls to $45, limiting their loss to $5 per share.

Position Sizing

Position sizing is the process of determining the appropriate amount of capital to allocate to each trade. This is crucial for controlling risk. By limiting the size of each trade, traders can ensure that any single loss does not significantly impact their overall portfolio. For instance, a trader might allocate only 2% of their portfolio to any single trade.

This ensures that even if the trade goes wrong, the overall portfolio is not significantly affected.

Diversification

Diversification involves spreading investments across various assets or markets. This reduces the impact of adverse events in a specific sector or market. A well-diversified portfolio reduces the risk of a significant loss if a particular asset underperforms. By investing in a range of securities, the trader reduces the overall volatility of their portfolio. This technique is also applicable to algorithmic trading strategies.

Incorporating Risk Management into a Trading Strategy

Risk management is not an add-on to a trading strategy; it’s an integral part of the strategy itself. When designing an algorithmic trading strategy, risk parameters should be incorporated from the outset. This includes specifying maximum position sizes, stop-loss levels, and diversification targets.

Potential Risks and Mitigation Strategies

Algorithmic trading is susceptible to several risks.

- Market Volatility: Sudden, unexpected market shifts can lead to substantial losses if the algorithm is not designed to handle such events. This can be mitigated by using stop-loss orders and position sizing to limit losses in volatile conditions. For instance, if a market crashes, the stop-loss order would trigger, preventing significant capital losses.

- System Failure: Technical issues with the trading system or connectivity problems can disrupt trading and lead to missed opportunities or unwanted transactions. This can be mitigated by implementing robust systems, backups, and redundancy protocols. Using multiple data feeds and having a contingency plan are examples of mitigation strategies.

- Data Errors: Inaccurate or outdated data can lead to erroneous trading decisions. This can be mitigated by employing reliable data sources, validating data inputs, and having a data quality control system.

- Model Errors: The predictive models used in algorithmic trading can be inaccurate, leading to poor trading decisions. This can be mitigated by using robust model validation techniques, testing models in various market conditions, and regularly updating the models.

- Over-Optimization: Over-optimizing a trading strategy on historical data can lead to poor performance in real-market conditions. This can be mitigated by employing out-of-sample testing and backtesting the model on different datasets.

Monitoring and Adjustment of Risk Parameters

The risk management parameters should be continuously monitored and adjusted based on market conditions, trading performance, and any changes in the trading strategy. A successful algorithmic trading system requires constant refinement and adjustment of risk parameters to maintain its effectiveness. Regularly review and revise risk limits to stay aligned with changing market conditions and the trader’s evolving investment goals.

Technology and Infrastructure for Algorithmic Trading

Algorithmic trading relies heavily on robust technology and infrastructure. The speed and accuracy of these systems are critical for generating profits and mitigating risk. This section delves into the essential components of this infrastructure.The core of algorithmic trading is the technology stack supporting the execution of trading strategies. This includes high-performance hardware, sophisticated software, and reliable data connections.

The system must be able to process vast amounts of data in real-time to make informed decisions and execute trades with minimal latency.

High-Speed Trading Platforms and Connectivity

Reliable and high-speed trading platforms are fundamental to successful algorithmic trading. These platforms enable rapid order placement and execution, crucial for capturing fleeting market opportunities. Connectivity to multiple exchanges is often required for accessing diverse market liquidity and minimizing execution costs.

Servers, Databases, and Communication Networks

The backbone of any algorithmic trading system is its infrastructure. High-performance servers are essential for processing complex calculations and executing trades quickly. Robust databases store and manage vast amounts of market data, historical price information, and other relevant data points. Fast and stable communication networks ensure that data flows seamlessly between different components of the system, including servers, databases, and trading platforms.

Latency in these networks can significantly impact trading outcomes.

Software and Hardware Components

The software used in algorithmic trading systems is often custom-developed, reflecting specific strategy requirements. This software typically includes modules for data ingestion, strategy execution, risk management, and reporting. Hardware components such as high-performance CPUs, GPUs, and specialized networking equipment are crucial for processing the vast amounts of data involved in algorithmic trading. Sophisticated data centers with redundant systems provide resilience to technical disruptions.

Comparison of Trading Platforms

Different trading platforms cater to various algorithmic trading needs. Their suitability depends on factors like the complexity of the strategy, required speed, and available resources.

Platform Strengths Weaknesses Suitability for Algorithmic Trading Platform A Excellent speed and low latency, robust API Limited customization options, higher cost Excellent for high-frequency trading strategies with established infrastructure. Platform B Flexible and customizable, extensive charting tools Higher latency compared to specialized platforms, less advanced API Suitable for medium-frequency trading strategies that require advanced charting capabilities. Platform C Open-source and cost-effective Requires significant development effort, less reliable infrastructure Ideal for smaller firms or traders developing custom strategies and having the expertise for the development.

The table above provides a general comparison. The optimal choice depends on the specific requirements of the trading strategy and the resources available.

Algorithmic trading is all about using computer programs to automate investment decisions. It’s a pretty cool way to execute trades, but often these systems need fast and reliable payment methods, like those offered by e-wallets like E-wallet. This allows for smoother transactions and quicker responses, which are key components of successful algorithmic trading strategies.

Regulatory and Legal Aspects of Algorithmic Trading

Algorithmic trading, while offering potential for increased efficiency and profitability, is subject to a complex regulatory environment. This necessitates a thorough understanding of the legal and regulatory frameworks governing its operation. The interplay between technology and finance demands clear guidelines to ensure fair and transparent markets.

Regulatory Environment Surrounding Algorithmic Trading

The regulatory environment for algorithmic trading is a constantly evolving landscape. It’s crucial to understand that regulations vary across jurisdictions, reflecting different approaches to managing financial markets. This creates a dynamic environment that necessitates ongoing vigilance and adaptation for algorithmic traders.

Impact of Regulations on Trading Strategies and Practices

Regulations significantly influence algorithmic trading strategies. Rules regarding order types, data access, and reporting requirements impact the design and execution of algorithms. For instance, restrictions on high-frequency trading strategies can lead to adjustments in algorithm design, impacting the speed and volume of trades. Furthermore, regulations on data usage and privacy directly affect how algorithmic trading strategies collect, process, and utilize information.

Algorithmic trading is all about using computer programs to make investment decisions. It’s become a pretty big deal, and a lot of these programs now use data from the blockchain, like the one powering Ethereum, Ethereum , to identify trading opportunities. This means traders can potentially benefit from quicker and more efficient analysis, boosting overall trading strategies.

Legal Implications of Using Algorithms in Financial Markets

The use of algorithms in financial markets carries legal implications, particularly concerning issues like market manipulation, fraud, and conflicts of interest. Algorithms can inadvertently contribute to market instability if not designed and monitored carefully. Ensuring compliance with regulations regarding market transparency and fair trading practices is crucial. Algorithms should be designed to avoid unintended consequences that could lead to regulatory violations.

Roles of Regulatory Bodies in Overseeing Algorithmic Trading

Regulatory bodies play a critical role in overseeing algorithmic trading. They establish guidelines, conduct examinations, and enforce rules to ensure the integrity and fairness of the markets. This includes monitoring for potential market manipulation, ensuring appropriate data access and usage, and enforcing reporting requirements. Examples of regulatory bodies include the Securities and Exchange Commission (SEC) in the US, and similar organizations in other countries.

History of Algorithmic Trading Regulations

The evolution of algorithmic trading regulations reflects the evolving nature of financial markets and technologies. Initially, regulations focused on general market conduct. Over time, as algorithmic trading became more prevalent, regulators developed specific rules and guidelines to address its unique characteristics. The early years of algorithmic trading saw a gap between the speed of technological advancement and the development of corresponding regulatory frameworks.

As technology progressed, regulators responded by creating more comprehensive regulations. This dynamic process continues, adapting to new challenges and ensuring the integrity of the financial system.

Ethical Considerations in Algorithmic Trading

Algorithmic trading, while offering potential benefits like increased speed and efficiency, also raises significant ethical concerns. These concerns revolve around fairness, transparency, and the potential for market manipulation, as well as the impact on market stability and overall investor confidence. The complex interactions between algorithms and human traders require careful consideration of the ethical implications.The use of algorithms in financial markets has led to a debate about the balance between technological advancement and ethical responsibility.

Algorithmic trading systems, designed to maximize profits, can sometimes inadvertently create conditions that negatively affect the integrity and fairness of the market. These issues demand careful attention from both industry professionals and regulators to maintain trust and stability in financial markets.

Algorithmic trading is all about using computer programs to automate investment decisions. It’s a pretty complex process, but often relies on stablecoins like Stablecoins to provide a stable base for calculations and transactions. This helps ensure consistent pricing and execution, which is crucial for algorithmic trading strategies to work effectively.

Fairness and Transparency in Algorithmic Trading

Algorithmic trading strategies can sometimes lead to situations where certain market participants may have an unfair advantage over others. Transparency in the workings of these algorithms is crucial to ensure fair market conditions. Lack of transparency can obscure the impact of automated trading on market prices, potentially harming individual investors.

Market Manipulation and Algorithmic Trading

The potential for algorithmic trading to be used for market manipulation is a major ethical concern. High-frequency trading (HFT) algorithms, designed for extremely rapid execution, can sometimes be programmed to exploit fleeting market inefficiencies or even create artificial price movements. This poses a significant risk to market stability and investor confidence. The rapid pace of algorithmic trading can exacerbate these risks.

A detailed examination of specific trading strategies and their potential for market manipulation is necessary to prevent unethical practices.

Algorithmic Trading and Market Volatility

Algorithmic trading strategies, while designed to maximize profits, can sometimes inadvertently exacerbate market volatility. The simultaneous execution of numerous algorithms can create large price swings, potentially destabilizing the market. The speed and scale of these trades can lead to unexpected and potentially damaging market reactions. Monitoring and managing the potential for increased volatility resulting from algorithmic trading is a critical element of market risk management.

Impact on Market Efficiency and Liquidity

Algorithmic trading has a profound effect on market efficiency and liquidity. While proponents argue that algorithms can improve price discovery and enhance liquidity, critics suggest that concentrated trading power could have a negative impact. The extent to which algorithms increase or decrease market efficiency and liquidity is an area of ongoing research and debate. Examining the historical impact of algorithmic trading on market depth and trading volumes is crucial to understanding its long-term effects.

Real-World Examples of Ethical Dilemmas

Several incidents in financial markets highlight the ethical challenges posed by algorithmic trading. One example involves the use of algorithms to exploit short-lived market inefficiencies, leading to accusations of market manipulation. Another example illustrates how the speed and volume of algorithmic trading can create sudden and unpredictable price fluctuations. These incidents serve as cautionary tales, highlighting the need for robust ethical frameworks and regulatory oversight.

Algorithmic trading is all about using computer programs to make investment decisions, often based on complex mathematical models. This can be a great way to automate trades and potentially increase profits, but sometimes it can be risky. One area where algorithmic trading can intersect with new investment opportunities is Initial Coin Offerings (ICO), Initial Coin Offering (ICO).

These offerings often involve tokens or cryptocurrencies that can be bought and sold, and algorithmic trading strategies could potentially be applied to those markets. Regardless, algorithmic trading still requires careful consideration of risk and market conditions.

Role of Market Participants in Maintaining Ethical Standards

Maintaining ethical standards in algorithmic trading requires a concerted effort from all market participants. Traders, brokers, and technology providers must prioritize transparency and fairness in their practices. Regulatory bodies play a critical role in establishing and enforcing ethical guidelines. The development and implementation of industry-wide best practices, coupled with strong regulatory oversight, are crucial for ensuring that algorithmic trading is conducted ethically.

Future Trends in Algorithmic Trading

Algorithmic trading is rapidly evolving, driven by advancements in technology and the increasing complexity of financial markets. This evolution is leading to a new era of automated strategies that are more sophisticated, responsive, and potentially more lucrative. The future of algorithmic trading hinges on the integration of cutting-edge technologies, especially artificial intelligence and machine learning.

Emerging Technologies and Innovations

The integration of artificial intelligence (AI) and machine learning (ML) is transforming algorithmic trading. AI algorithms can analyze vast datasets of market data, identifying patterns and anomalies that might be missed by traditional methods. ML algorithms can learn from historical data, adapt to changing market conditions, and refine trading strategies over time. This adaptability is crucial in today’s dynamic financial markets.

Impact on Trading Strategies

Technological advancements are significantly impacting trading strategies. High-frequency trading (HFT) strategies, already prevalent, are becoming even more sophisticated, leveraging faster processing speeds and complex algorithms to capture fleeting market opportunities. Furthermore, the ability to process and analyze vast quantities of data is enabling the development of more nuanced and sophisticated strategies. For example, strategies that incorporate sentiment analysis from social media or news feeds are gaining traction, adding a layer of real-time market sentiment to the mix.

Impact on Financial Markets

The widespread adoption of algorithmic trading is reshaping the landscape of financial markets. Increased automation leads to faster execution speeds and reduced human error, contributing to greater market liquidity and efficiency. However, this increased automation also raises concerns about market manipulation and potential disruptions caused by large-scale automated trading activity. Furthermore, the complexity of these systems can make it challenging to understand the underlying mechanics and potential risks.

Changes in Risk Management

Algorithmic trading demands a new approach to risk management. Traditional risk management models may not fully capture the nuances of complex AI-driven strategies. As algorithms become more sophisticated, risk management systems must evolve to adapt and identify potential vulnerabilities. This necessitates a deeper understanding of the algorithms’ behavior and their interactions with the market.

Examples of Emerging Technologies

Several emerging technologies are transforming algorithmic trading. Natural Language Processing (NLP) allows algorithms to interpret and analyze news articles, social media posts, and other textual data to identify potential market-moving events. This can lead to strategies that anticipate market trends before they are reflected in price movements. Similarly, blockchain technology can enhance the security and transparency of trading processes, leading to a more trust-worthy and efficient trading environment.

For instance, blockchain-based platforms can automate the execution of trades, reducing counterparty risk.

Final Summary

In conclusion, algorithmic trading is a complex and rapidly evolving field. From its core principles to the sophisticated technologies it utilizes, understanding algorithmic trading is essential for anyone interested in the modern financial world. The future of trading is likely to be increasingly automated, so gaining knowledge of this dynamic area is critical.

Key Questions Answered

What are some common algorithmic trading strategies?

Common strategies include high-frequency trading, arbitrage, and trend-following. Each relies on different data inputs and trading rules.

What are the key risks of algorithmic trading?

Potential risks include system failures, unexpected market events, and the potential for unintended consequences from complex algorithms. Proper risk management is critical.

What role does data play in algorithmic trading?

Data is the lifeblood of algorithmic trading. It’s used to identify patterns, predict market movements, and execute trades. Different strategies rely on different data sources and types.

How do regulations affect algorithmic trading?

Regulations are crucial to ensure fairness, transparency, and prevent market manipulation. They often impact the design and implementation of trading strategies.