Usage-based insurance (UBI) is changing how we think about car insurance. Instead of a flat rate, your premiums are now tied to your driving habits. This means safer drivers pay less, while riskier drivers pay more. It’s a system built on data, using telematics to track driving patterns and personalize your coverage.

This innovative approach has the potential to revolutionize the insurance industry, creating a more efficient and personalized system. The system aims to provide better pricing based on actual driving behaviors. It also allows insurers to better assess risk, and ultimately, offer more affordable coverage for safe drivers.

Introduction to Usage-Based Insurance (UBI)

Source: articlegods.com

Usage-Based Insurance (UBI) is a revolutionary approach to car insurance that dynamically adjusts premiums based on how a driver uses their vehicle. Instead of relying solely on factors like age and location, UBI leverages data collected from the vehicle itself to assess risk and reward safe driving habits. This data-driven approach aims to create a more fair and efficient insurance system, potentially lowering costs for safe drivers while increasing them for those who drive more aggressively or take more risks.UBI works by collecting data on driving patterns, such as speed, acceleration, braking, and mileage.

This data is then analyzed to determine a driver’s risk profile, which in turn influences their insurance premium. The core principle is that safe drivers are rewarded with lower premiums, while those who drive less safely pay higher premiums. This approach incentivizes responsible driving habits and encourages drivers to improve their safety scores. UBI is built on a foundation of advanced telematics and sophisticated algorithms that convert driving data into meaningful insights for insurers.

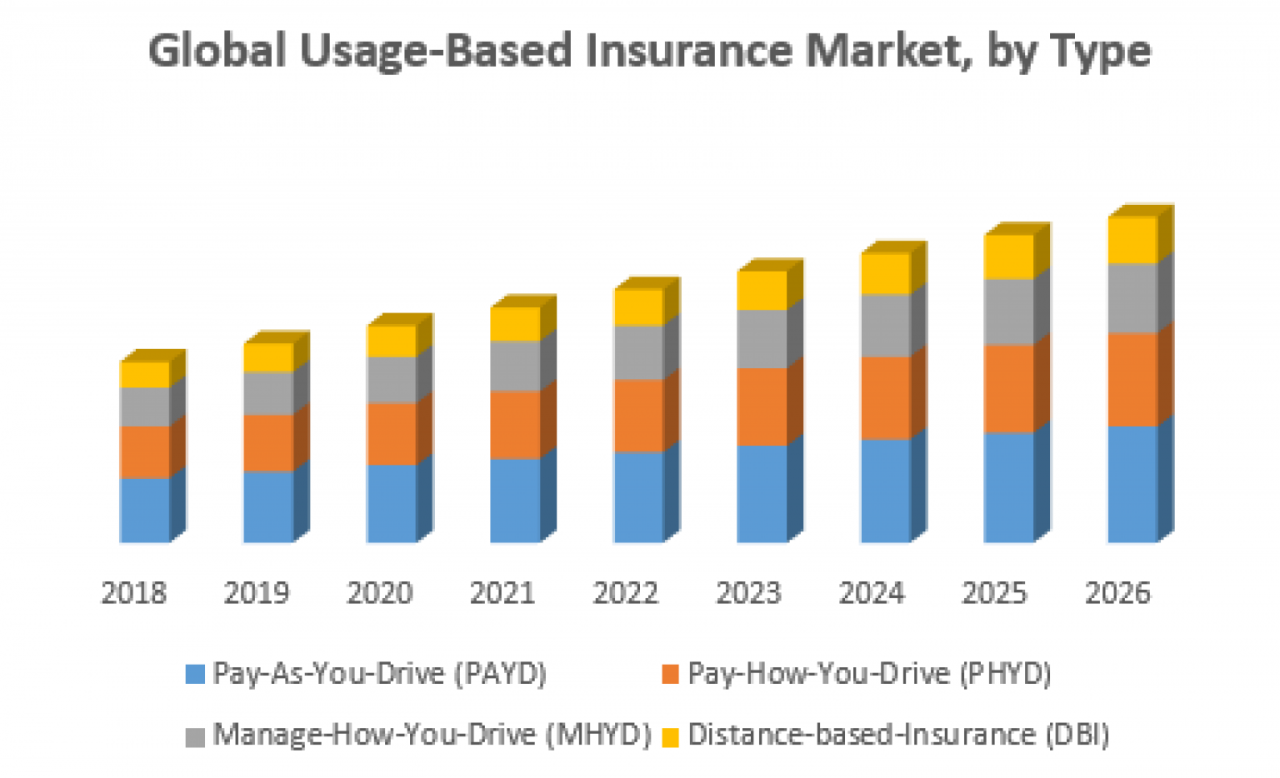

Types of UBI Programs

Various UBI programs are designed to cater to specific needs and contexts. The types vary in the scope of data collected and the corresponding adjustments to premiums. Each program usually focuses on a specific area or aspect of driving behaviour to be rewarded or penalized.

UBI Program Types and Coverage Areas, Usage-based insurance (UBI)

| Program Type | Coverage Area | Example | Data Used |

|---|---|---|---|

| Mileage-Based | Frequency and amount of driving | Lower premiums for drivers who drive less | Odometer readings, trip data |

| Speed and Acceleration-Based | Driving speed and sudden changes in speed | Lower premiums for drivers who maintain a consistent speed and avoid harsh acceleration | GPS data, accelerometer data |

| Braking and Hazard Avoidance-Based | Frequency and intensity of braking and avoiding hazards | Lower premiums for drivers who react promptly and safely to hazards | Brake sensor data, accident avoidance metrics |

| Route Optimization-Based | Efficient route planning and adherence to suggested routes | Lower premiums for drivers who use optimal routes | GPS data, navigation app usage |

| Driver Behavior Monitoring-Based | Driver attentiveness, phone usage, and distractions | Lower premiums for drivers who maintain focus and avoid distractions | Phone usage data, driver behavior score based on a set of criteria |

User Journey in a UBI Program

The user journey typically begins with the installation of a telematics device in the vehicle. This device collects driving data and transmits it to the insurance provider. The data is analyzed, and a risk score is calculated. Based on this score, the insurance premium is determined and adjusted accordingly. Drivers can monitor their driving data and performance through a user-friendly app or online portal, often seeing real-time feedback and progress toward a better safety score.

Regular communication with the insurance company is a key part of the process, keeping drivers informed about their driving habits and associated premium changes.

UBI Data Collection and Analysis: Usage-based Insurance (UBI)

Usage-based insurance (UBI) relies heavily on data collection and analysis to accurately assess risk and tailor premiums. This data-driven approach allows insurers to better understand driving behaviors and adjust rates accordingly, ultimately creating a more efficient and personalized insurance experience for customers.Data collection methods are crucial for the success of UBI programs. A well-structured system ensures the quality and integrity of the data used to calculate premiums and provide insights into driving habits.

The methods used, coupled with the types of data gathered, directly impact the accuracy and effectiveness of the UBI model.

Usage-based insurance (UBI) is becoming increasingly popular, and it’s all about rewarding safe driving habits. This system could really benefit from Blockchain technology, which could create a secure and transparent platform for tracking driving data and calculating premiums. Ultimately, this could lead to more affordable and personalized UBI plans for drivers.

Data Collection Methods

Various methods are employed to gather the necessary data for UBI programs. These methods include the use of telematics devices, GPS tracking, and driver-reported data. The choice of method often depends on the specific program and its intended goals.

- Telematics Devices: These devices, often installed in vehicles, continuously monitor driving data, including speed, acceleration, braking, and location. This real-time data provides a comprehensive picture of driving habits, allowing for a more precise assessment of risk.

- GPS Tracking: GPS systems provide precise location data, enabling detailed analysis of routes, driving patterns, and trip durations. This data can be integrated with telematics data to paint a more complete picture of driving behavior.

- Driver-Reported Data: Some UBI programs incorporate driver-reported data, such as mileage logs or specific driving events. This approach can supplement data collected from telematics devices and provide additional context.

Types of Data Collected

The data collected in UBI programs is multifaceted and encompasses various aspects of driving behavior. The accuracy and comprehensiveness of this data are critical to the success of the program.

- Driving Patterns: Data on driving patterns, such as frequency of trips, typical routes, and time of day, helps insurers understand how drivers utilize their vehicles. This information is often analyzed to identify high-risk behaviors or driving habits.

- Mileage: The total mileage driven is a crucial factor in determining risk. Higher mileage often correlates with increased wear and tear on vehicles, potentially leading to higher accident probabilities.

- Speed: Speed data reveals driving habits and can be analyzed to identify instances of aggressive driving or unsafe speeds. Variations in speed over time can also provide insights into driving behavior.

Technology for Data Collection

Telematics devices are the primary technology employed in UBI programs. These devices are sophisticated tools that facilitate the collection of detailed driving data.

- Telematics Devices: These devices, often embedded in vehicles, use a combination of sensors, GPS receivers, and communication modules to capture driving data in real-time. Modern devices can record a wide range of data points with high accuracy.

Data Organization and Analysis

Efficient organization of the collected data is essential for meaningful analysis and reporting. This structure allows for efficient data processing and provides clear insights for risk assessment.

- Data Storage and Management: A robust data storage and management system is critical for UBI programs. This system should be designed to handle large volumes of data, ensure data integrity, and facilitate efficient retrieval for analysis.

- Data Aggregation: Collected data is aggregated and processed to create meaningful reports and visualizations. This process involves combining data from various sources, such as telematics devices and driver reports.

- Data Visualization: Data visualization tools are employed to present complex data in an easily understandable format. Dashboards and reports are often used to present key metrics and insights to insurers and drivers.

Risk Assessment

Collected data is used to assess risk in several ways. This process is key to determining appropriate premiums for individual drivers.

- Statistical Modeling: Statistical models are used to analyze the relationship between driving behavior and accident risk. These models help identify factors associated with higher accident probabilities.

- Behavioral Analysis: Analysis of driving patterns, such as sudden acceleration or braking, can help identify risky driving behaviors. Patterns can be correlated with accident risk to inform pricing strategies.

Example Dashboard

A UBI dashboard might display key metrics such as average speed, mileage driven, and number of hard braking events. This visualization allows insurers to monitor trends and patterns in driver behavior.

| Metric | Value |

|---|---|

| Average Speed | 55 mph |

| Total Mileage | 10,000 miles |

| Hard Braking Events | 12 |

UBI Pricing and Premiums

Usage-based insurance (UBI) programs fundamentally change how premiums are calculated, moving away from traditional, often static, models. Instead of relying solely on factors like age, location, and vehicle type, UBI leverages data on actual driving habits to tailor premiums to individual drivers. This personalized approach promises to be fairer and more cost-effective for both insurers and policyholders.UBI premiums are determined by analyzing a driver’s driving behavior and vehicle characteristics.

The more detailed the data, the more precise the calculation can be. This approach often leads to lower premiums for safe drivers and higher premiums for those with risky driving habits.

Premium Calculation Factors

UBI premiums are calculated based on various factors, meticulously collected and analyzed from data sources. These factors encompass not only driving habits but also vehicle characteristics. Crucially, the data collected is specific to the individual driver, reflecting real-world performance.

- Driving Behavior: This is a core element of UBI. Factors like speed, acceleration, braking, hard turns, and overall driving style are analyzed. A driver consistently adhering to speed limits and demonstrating smooth maneuvers would likely have a lower premium compared to one with frequent speeding or aggressive driving.

- Vehicle Type: The type of vehicle, including its make, model, and features, significantly impacts the premium calculation. For example, a vehicle with advanced safety features or lower fuel efficiency might have a different premium than a vehicle with a higher risk of accident involvement.

- Mileage: The total mileage driven, and more specifically, the mileage driven during specific periods (e.g., monthly or quarterly) is a critical factor. Higher mileage often correlates with higher premiums.

- Time of Day/Day of Week: Data on when and where a driver is most active can help predict potential risk. Drivers who drive frequently during high-accident periods may face a higher premium.

Comparison with Traditional Insurance Models

Traditional insurance premiums are typically based on broad, generalized risk profiles. These models often rely on factors like the driver’s age, location, and vehicle type, which may not accurately reflect individual driving habits. This can result in premiums that are either too high for safe drivers or too low for risky ones.

| Factor | Traditional Insurance | UBI |

|---|---|---|

| Premium Determination | Based on general risk profiles, often inaccurate for individual behavior | Based on individual driving behavior and vehicle characteristics |

| Cost Adjustment | Rarely adjusted based on individual driving performance | Regularly adjusted based on usage data |

| Data Source | Limited data on individual driving habits | Real-time data on individual driving habits |

| Fairness | Potentially unfair, with safe drivers paying similar premiums to risky ones | Potentially fairer, with premiums tailored to individual behavior |

UBI Premium Adjustment

UBI premiums are not static. They are regularly adjusted based on the collected usage data. This dynamic approach allows for immediate feedback and adaptation to changing driving habits. For example, a driver who significantly improves their driving behavior over time may see a decrease in their premium. Conversely, a driver who adopts riskier habits might face an increase.

Usage-based insurance (UBI) is getting pretty popular, and it’s all about rewarding safe drivers. It’s similar to fractional investing, where you can invest in things like stocks and bonds without having to buy a whole lot, allowing you to spread your risk. This kind of shared risk approach could lead to some really interesting innovations in UBI, allowing for more personalized and potentially lower premiums for drivers.

This constant adjustment makes the system more responsive to real-world driving performance.

Example Premium Calculation Model

Let’s consider a simplified example. A UBI program might use a formula like this:

Premium = Base Rate + (Mileage

Usage-based insurance (UBI) is becoming increasingly popular, rewarding safe drivers with lower premiums. This innovative approach could potentially benefit from the technology and investment opportunities offered by Initial Coin Offerings (ICO), Initial Coin Offering (ICO) , which could help streamline the process and potentially even lower the cost of insurance for everyone. Ultimately, UBI’s future looks bright, thanks to these emerging technologies.

- Mileage Rate) + (Risk Score

- Risk Rate)

Where:* Base Rate: A standard premium based on vehicle type and location.

Mileage

The total miles driven in a specific period.

Mileage Rate

A factor reflecting the risk associated with mileage.

Risk Score

A score calculated based on driving behavior.

Risk Rate

A factor reflecting the risk associated with the driver’s risk score.A driver with a low mileage and a good risk score would have a lower premium compared to a driver with high mileage and a high risk score. The system allows for a constant recalibration of the premium based on the driver’s behavior.

UBI Benefits and Drawbacks

Usage-based insurance (UBI) is rapidly changing the landscape of the insurance industry. Understanding both the potential advantages and disadvantages is crucial for both insurers and policyholders. This section will explore the benefits for both parties, highlight potential challenges, and examine the vital role of technology in UBI’s implementation and management. Furthermore, we will analyze the regulatory environment that shapes UBI programs.Analyzing the advantages and disadvantages of UBI programs is essential for informed decision-making by both insurers and policyholders.

Understanding these factors allows for a balanced perspective on the potential benefits and challenges associated with UBI.

Potential Advantages for Insurers

Insurers stand to gain significant benefits from implementing UBI programs. Reduced claims costs are a major advantage. By analyzing driving habits and other usage patterns, insurers can identify high-risk drivers and tailor premiums accordingly. This can lead to lower overall claim payouts and improved profitability. Furthermore, increased data collection can lead to more accurate risk assessment, resulting in a more precise and personalized approach to pricing.

Potential Benefits for Policyholders

Policyholders can also reap numerous advantages from UBI. Personalized pricing is a significant benefit. Drivers with safe driving habits can potentially receive lower premiums, reflecting their lower risk profile. This incentivizes safe driving behavior and promotes responsible use of vehicles. UBI can also empower policyholders by providing data and insights into their own driving habits, which can encourage positive behavioral changes.

Potential Drawbacks or Challenges Associated with UBI

Despite the advantages, UBI programs face several challenges. Data privacy concerns are a critical consideration. Collecting and using personal driving data raises significant privacy issues. Transparency and clarity in data usage are essential to build trust and ensure compliance with privacy regulations. Furthermore, there are concerns regarding potential bias in algorithms used to analyze data and determine premiums.

The potential for discriminatory pricing based on demographic or other factors needs careful consideration and mitigation.

Role of Technology in Implementing and Managing UBI Programs

Technology plays a crucial role in the success of UBI programs. Advanced telematics devices are essential for collecting data on driving habits. These devices track speed, acceleration, braking, and other driving parameters. Data analytics tools are also crucial for processing and analyzing the collected data. Robust data security measures are essential to protect sensitive personal information.

Furthermore, the use of cloud-based platforms can facilitate the efficient storage and processing of vast amounts of data.

Regulatory Environment Impacting UBI Programs

The regulatory landscape surrounding UBI programs is evolving. Governments worldwide are working to establish clear guidelines for data collection, usage, and privacy. Compliance with regulations regarding data security and privacy is paramount. These regulations may vary across jurisdictions, creating a complex environment for insurers operating in multiple markets. Regulatory changes can influence the implementation and operation of UBI programs, demanding constant vigilance and adaptation.

Comparison of Advantages and Disadvantages of UBI Programs

| Advantage | Disadvantage |

|---|---|

| Reduced claims costs due to more accurate risk assessment | Data privacy concerns, potential for bias in algorithms |

| Personalized pricing based on driving behavior | Complexity in data collection and analysis, potential for discriminatory pricing |

| Increased transparency in pricing and risk factors | Regulatory complexities and compliance requirements |

| Potential for incentivizing safe driving habits | Need for robust technology infrastructure and data security measures |

Future Trends and Developments in UBI

Usage-based insurance (UBI) is rapidly evolving, driven by advancements in technology and the growing need for personalized insurance solutions. This evolution promises to reshape the insurance landscape, offering both exciting opportunities and potential challenges. The future of UBI will be characterized by a shift from traditional, one-size-fits-all models to more dynamic and personalized approaches.The future of UBI will be shaped by the continued integration of data analytics, artificial intelligence (AI), and the Internet of Things (IoT).

These technologies will enable insurers to gain a more comprehensive understanding of driver behavior, vehicle performance, and environmental factors, leading to more accurate risk assessments and pricing models.

Usage-based insurance (UBI) is getting more popular, and it’s all about rewarding safe drivers. This often involves using credit scoring algorithms to assess risk, which is a key element in determining premiums. These algorithms, as detailed on this page about Credit scoring algorithms , help insurers make more accurate predictions of future driving behavior, ultimately influencing the UBI rates.

The better you drive, the lower your premiums are likely to be.

Potential Innovations in Data Collection and Analysis for UBI

Data collection for UBI is moving beyond traditional methods. Telematics data, already a mainstay, is expanding to include more sophisticated sensors and real-time data streams. For instance, advanced driver-assistance systems (ADAS) are becoming increasingly integrated into vehicles, providing detailed insights into braking patterns, acceleration, and lane changes. This real-time data allows for a more nuanced understanding of driving habits and risk factors.

Furthermore, predictive modeling techniques, powered by AI, are being used to identify potential risky driving situations before they occur, enabling proactive interventions and personalized risk mitigation strategies.

Future Applications of UBI Beyond Traditional Car Insurance

The potential applications of UBI extend far beyond car insurance. For instance, UBI principles can be applied to home insurance, where smart home devices can track energy consumption, security breaches, and other factors influencing risk. Similarly, UBI can revolutionize personal accident insurance by using wearable technology to monitor health and activity levels, allowing for more personalized premiums and proactive health management programs.

This personalization allows insurance to adapt to individual needs and behaviors, moving away from a one-size-fits-all approach.

Potential Impact of UBI on the Insurance Industry

UBI is poised to transform the insurance industry by fostering greater transparency, efficiency, and customer engagement. Insurers can utilize data-driven insights to offer customized pricing and risk mitigation strategies, leading to increased customer satisfaction. Furthermore, UBI has the potential to reduce insurance costs for responsible drivers and policyholders, leading to more accessible and affordable insurance options. The efficiency gains in risk assessment and claims processing can lead to lower administrative costs for insurers.

Evolving Legal and Ethical Considerations Related to UBI

The increasing use of data in UBI raises critical legal and ethical concerns. Privacy regulations and data security measures are crucial to protect sensitive information collected by UBI systems. Furthermore, the potential for bias in algorithms used for risk assessment needs careful consideration and mitigation strategies. Ensuring equitable and fair application of UBI is vital to maintain public trust and prevent discrimination.

Data security and privacy are essential components of the implementation of UBI systems.

Potential for Personalization in UBI Programs

UBI allows for a high degree of personalization, tailoring insurance products to individual needs and behaviors. For example, insurers can offer different coverage options, discounts, and risk mitigation strategies based on individual driving profiles or home usage patterns. This personalized approach results in more efficient allocation of resources and increased customer satisfaction, as insurance products align more closely with individual needs.

A personalized approach to risk assessment and premium pricing is one of the most significant benefits of UBI.

UBI and Customer Experience

Usage-based insurance (UBI) programs are transforming the insurance landscape, but a crucial element for success is a positive customer experience. A well-designed platform and effective communication are essential to building trust and loyalty among policyholders. A seamless experience encourages adoption and repeat business, ultimately driving the long-term viability of UBI models.A successful UBI program requires more than just collecting and analyzing data; it necessitates a user-friendly platform that empowers customers to understand their driving habits and manage their insurance costs.

This includes clear, concise information about data collection, usage reports, and premium adjustments.

User-Friendly Platform Design

A user-friendly platform is crucial for positive customer interaction with UBI. This platform should offer intuitive navigation, clear explanations of data collection methods, and personalized insights into driving behavior. Visualizations, like graphs and charts, effectively communicate complex data points, allowing drivers to see patterns and understand how their habits affect their premiums. Easy-to-understand explanations of pricing models and premium adjustments are essential for transparency and trust.

The platform should be accessible across multiple devices, ensuring a consistent experience for users regardless of their preferred method of access.

Usage-based insurance (UBI) is becoming more popular, and it’s changing how we think about car insurance. This often involves data collection and analysis, which is where online brokerage platforms, like Online brokerage , are playing a huge role. The ability to compare rates and tailor policies based on individual driving habits is a huge plus for UBI programs.

Effective Communication Examples

Effective communication is key to fostering trust and understanding within UBI programs. Clear and concise communication about data collection, usage reports, and premium adjustments builds trust and reduces anxiety. Transparency about how data is used and how it impacts premiums is paramount.

- Personalized Communication: Sending tailored messages based on individual driving habits and premium adjustments can enhance understanding and engagement.

- Regular Updates: Providing frequent updates on driving behavior and premium changes, ideally through email or mobile app notifications, keeps policyholders informed and involved.

- Educational Resources: Offering online guides, FAQs, and videos that explain the intricacies of UBI, including how data is collected and used, promotes a sense of control and understanding.

- Dedicated Customer Support: Having readily available customer support channels, such as phone, email, or chat, to address questions and concerns promptly, is vital.

Improving Customer Engagement and Satisfaction

Customer engagement and satisfaction are directly linked to the overall success of UBI programs. Active participation in the program encourages customers to adopt safer driving habits and manage their premiums effectively. This, in turn, fosters a positive feedback loop that benefits both the customer and the insurer.

- Incentivize Safe Driving: Rewarding safe driving behavior with discounts or other incentives encourages positive habits and reinforces the value proposition of UBI.

- Proactive Feedback: Offering insights into areas for improvement in driving behavior and suggesting strategies to reduce costs, based on data analysis, can foster a collaborative relationship between the customer and the insurance provider.

- Personalized Recommendations: Providing tailored recommendations based on individual driving patterns and safety scores can improve customer satisfaction and encourage continued engagement.

Communication Strategies for UBI

Effective communication is essential for successful UBI programs. A well-structured approach that addresses the different needs and preferences of policyholders can lead to higher engagement and satisfaction.

| Communication Channel | Example Message |

|---|---|

| “Based on your recent driving data, we’ve noticed a decrease in speed. This has resulted in a reduction in your premium.” | |

| Mobile App | “Your current driving score is 95. Maintain this behavior to receive a discount next billing cycle.” |

| SMS | “Reminder: Review your driving habits and insights on the UBI mobile app to see how your driving behavior affects your premiums.” |

| Website | “Detailed explanations of UBI data collection methods, pricing models, and usage reports are available on our website. Explore the resources to gain a comprehensive understanding.” |

Transparency and Trust in UBI

Transparency and trust are fundamental to the success of any UBI program. Customers need to understand how their data is collected, used, and how it affects their premiums. Open communication and readily available information foster trust and confidence in the program. This, in turn, encourages participation and reduces concerns about data privacy and security.

Closure

In conclusion, Usage-based insurance (UBI) offers a promising future for the insurance industry. By leveraging data and technology, UBI can provide more tailored coverage and potentially lower premiums for responsible drivers. However, there are challenges, such as privacy concerns and the need for trust. The future of UBI hinges on addressing these concerns and adapting to the evolving landscape of technology and regulation.

FAQ Resource

How does UBI collect data?

UBI programs typically use telematics devices, like black boxes in cars, to track driving data, including speed, mileage, and location.

What factors affect UBI premiums?

Your driving habits, such as speed, acceleration, braking, and mileage, are key factors in determining your premium. Vehicle type also plays a role.

Is UBI data private?

Privacy is a significant concern. Regulations and secure data handling protocols are crucial to ensure the privacy and security of collected data.

How can I improve my UBI score?

Drive safely and responsibly. Avoid speeding, aggressive driving, and risky maneuvers. The more cautious you are, the lower your premium will be.