Digital wallets are rapidly changing how we handle money. From simple mobile payment apps to sophisticated hardware solutions, they offer a convenient and secure alternative to physical wallets. This overview explores the evolution of digital wallets, delving into their security, benefits, user experience, and future trends. We’ll also examine the regulatory landscape and how they integrate with other financial services.

The shift from physical to digital wallets reflects a broader trend toward digitalization in finance. This evolution brings both exciting opportunities and potential challenges, making it a crucial topic for consumers, businesses, and regulators alike. We’ll explore the key differences and functionalities of various digital wallet types to understand their diverse applications.

Introduction to Digital Wallets

A digital wallet is a virtual repository for storing payment information, such as credit cards, debit cards, and loyalty cards, alongside other important credentials like IDs and driver’s licenses. It acts as a secure, convenient alternative to carrying physical cards, streamlining transactions and offering enhanced security features.The evolution of digital wallets has been remarkable, starting from early concepts of online payment systems to the sophisticated mobile apps we use today.

Early iterations focused primarily on storing credit card details for online purchases, but modern implementations extend far beyond this, encompassing various payment methods, loyalty programs, and even digital IDs. This evolution has been driven by increasing user demand for convenience, security, and seamless integration with daily activities.

Defining Digital Wallets

Digital wallets are software-based systems designed to hold and manage various payment methods and personal information securely. They eliminate the need for physical wallets, allowing users to store and access their financial and identification information electronically. The underlying technology varies from simple online storage to sophisticated mobile applications.

Key Differences Between Physical and Digital Wallets

Physical wallets, relying on physical cards and documents, are prone to loss, damage, and potential fraud. Digital wallets, in contrast, offer enhanced security through encryption and authentication measures. Digital wallets also provide greater convenience by consolidating multiple payment methods and documents into a single, accessible platform.

Types of Digital Wallets

Digital wallets come in various forms, each with unique strengths and weaknesses. Understanding these differences is crucial for selecting the appropriate type for your needs.

Digital wallets are becoming increasingly popular, offering a convenient way to manage finances. They’re often linked to challenger banks, which are newer, innovative financial institutions. These challenger banks are often more focused on digital services and are really shaking up the traditional banking scene, and that directly impacts the evolution of digital wallets. This means more features and options for users, ultimately leading to a more seamless and user-friendly digital wallet experience.

Challenger banks are driving this evolution, and the future of digital wallets is looking pretty bright.

| Feature | Mobile Wallets | Hardware Wallets | Software Wallets |

|---|---|---|---|

| Security | Generally good, relying on mobile device security and encryption. Often integrate with biometric authentication. | Extremely secure, using dedicated hardware and cryptographic security. Typically less susceptible to malware and breaches. | Security varies greatly depending on the provider and platform. Potential for vulnerabilities if the software is not regularly updated. |

| Accessibility | High accessibility, readily available on smartphones and tablets. | Limited accessibility, often requiring a dedicated device. | Accessibility depends on internet connectivity and the platform’s availability. |

| Functionality | Wide range of functions, including payments, loyalty programs, and potentially digital IDs. | Primarily focused on secure storage of cryptocurrencies and digital assets. | Offers flexibility, often acting as a digital repository for various information and services. |

Security and Privacy Concerns

Digital wallets, while convenient, introduce new security and privacy challenges. Users need to understand the measures employed to protect their funds and personal data. Protecting sensitive information is paramount in this digital landscape.

Security Measures in Digital Wallets

Digital wallets utilize a variety of security measures to protect user funds and data. These include encryption, multi-factor authentication, and secure storage protocols. Encryption scrambles data, making it unreadable to unauthorized parties. Multi-factor authentication adds layers of security, requiring users to verify their identity with multiple methods, such as a code sent to their phone or a biometric scan.

Secure storage protocols ensure data is kept safe and inaccessible without proper authorization.

Potential Vulnerabilities and Risks

Digital wallets are susceptible to various threats. Phishing attacks, where malicious actors attempt to trick users into revealing login credentials, pose a significant risk. Malware infections, which can compromise a device and steal sensitive information, are another major concern. Data breaches, where large amounts of data are stolen, can have severe consequences for individuals. Poorly designed or implemented security protocols can also lead to vulnerabilities.

A weak password, for example, can be easily cracked, leaving accounts vulnerable to unauthorized access. These risks underscore the importance of user vigilance and robust security measures.

Comparison of Security Protocols

Different security protocols offer varying levels of protection. Advanced encryption standards (AES) are commonly used to secure sensitive data. Two-factor authentication (2FA) adds an extra layer of security, requiring a second form of verification besides a password. Biometric authentication, such as fingerprint or facial recognition, is becoming increasingly popular for its convenience and high security. Each protocol has strengths and weaknesses, and the best approach often involves a combination of these techniques.

User Privacy Considerations

User privacy is a crucial aspect of digital wallets. Users should be aware of how their data is collected, stored, and used. Transparent data policies and user controls are essential for maintaining trust. Data minimization principles, where only necessary data is collected, can also improve privacy. Users should review and understand the privacy policies of the wallet provider.

Best Practices for Protecting Digital Wallet Credentials

Strong passwords are crucial. Use a unique and complex password for each account. Enable two-factor authentication wherever possible. Be cautious of suspicious emails or messages. Keep software updated to patch security vulnerabilities.

Regularly review account activity and report any suspicious transactions immediately.

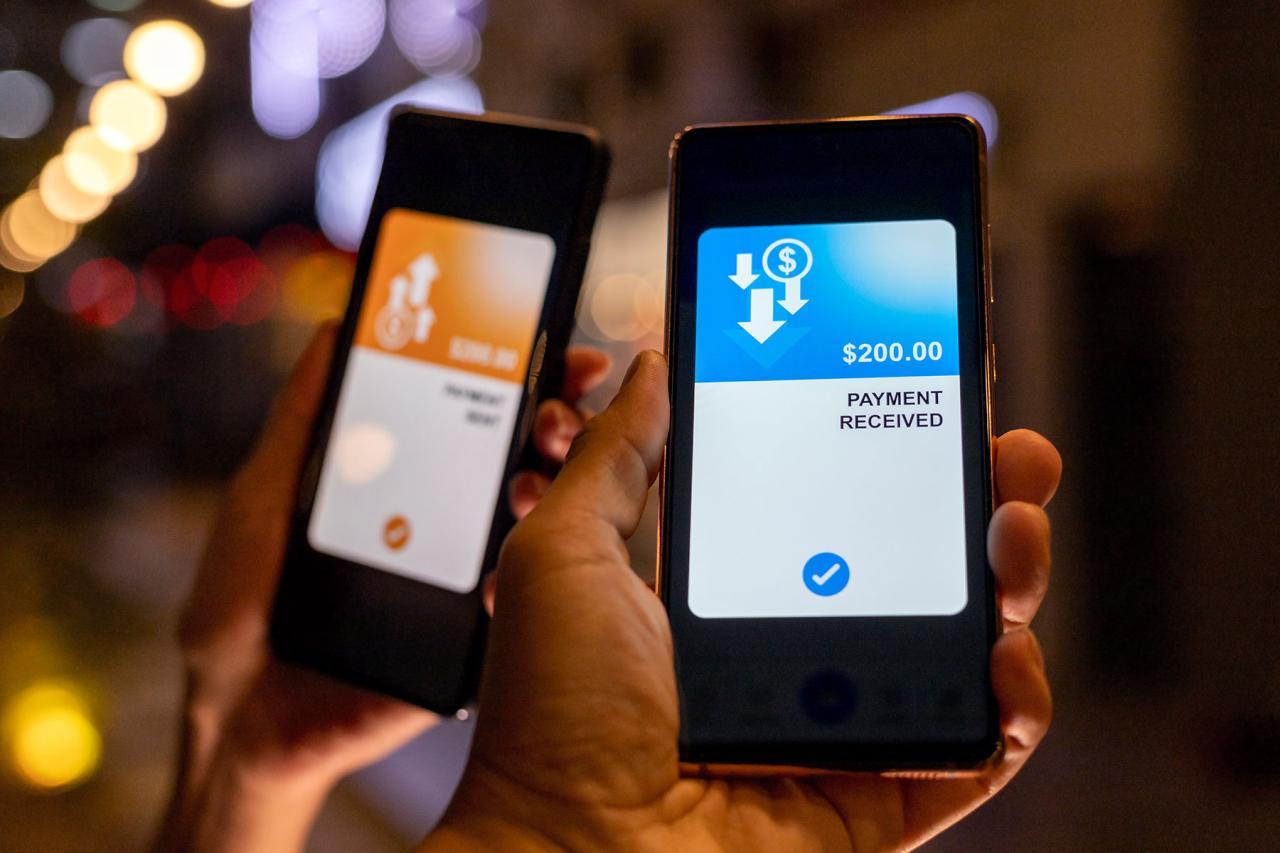

Digital wallets are becoming increasingly popular, offering a convenient way to handle payments. They’re essentially a digital version of your physical wallet, making mobile payments much easier. Services like these often integrate with various payment systems, allowing for seamless transactions using a smartphone. For a deeper dive into the world of mobile payments, check out this resource: Mobile payments.

Ultimately, digital wallets streamline the entire process, from paying for groceries to making online purchases.

Common Security Threats and Preventative Measures

| Threat | Prevention |

|---|---|

| Phishing | Be wary of unsolicited emails or messages requesting personal information. Verify requests directly with the wallet provider. Look for suspicious grammar or formatting in emails. |

| Malware | Install reputable antivirus software and keep it updated. Avoid downloading files from untrusted sources. Exercise caution when clicking on links or attachments. |

| Data breaches | Choose strong passwords and enable multi-factor authentication. Be mindful of where you store your wallet credentials. Report any suspicious activity immediately. |

Benefits and Advantages of Digital Wallets

Digital wallets have revolutionized how we manage and use money. They offer a multitude of advantages over traditional physical wallets, enhancing convenience, security, and financial inclusion for both consumers and businesses. This shift from tangible to digital has streamlined transactions and reduced the risk of loss or theft.Digital wallets streamline financial transactions in numerous ways. By eliminating the need for physical cash or cards, they facilitate quicker and more efficient payments.

Digital wallets are becoming super popular, and they’re heavily reliant on contactless payments. Using a digital wallet, you can make quick and easy purchases using your phone or card, like using Contactless payments at stores. This makes everyday transactions much smoother, and that’s why digital wallets are so convenient.

This efficiency translates to a significant time savings for both consumers and businesses. Furthermore, digital wallets’ ability to store multiple payment methods in one convenient location reduces the risk of forgetting or misplacing cards.

Convenience and Speed of Digital Transactions

Digital wallets offer unparalleled convenience due to their portability and accessibility. Users can access their funds and make payments from virtually anywhere with an internet connection. This accessibility eliminates the need for physical cash or cards, simplifying transactions and saving time. For instance, a quick scan of a QR code can initiate a payment, bypassing the need for manual entry of card details.

This speed is particularly beneficial in situations where time is critical, such as in-store purchases or online payments.

Streamlined Financial Transactions

Digital wallets significantly streamline financial transactions, automating processes and reducing manual effort. Instead of manually entering credit card details, users can simply tap their phone or smartwatch to make a payment, saving time and reducing the risk of errors. This automated process can be further enhanced by integrating with other services like loyalty programs or rewards schemes. For example, a user might earn rewards points automatically when making a purchase using their digital wallet.

Advantages for Businesses

Digital wallets offer businesses numerous advantages, including increased efficiency and improved customer experience. Businesses can accept payments from a wider range of sources, enabling them to reach more customers. This broadens their customer base and improves their market penetration. Moreover, the data generated by digital wallets can be invaluable for understanding customer preferences and tailoring marketing strategies.

Advantages for Consumers

Digital wallets offer consumers a variety of benefits, including enhanced security, convenience, and greater financial control. Consumers can easily track their spending and manage their finances effectively. They can also access their funds and make payments anytime, anywhere. For instance, a consumer can easily check their balance or make a payment while waiting in line at the store, or even while traveling abroad.

Financial Inclusion

Digital wallets have the potential to promote financial inclusion, particularly in underserved communities. By providing access to financial services without the need for traditional banking infrastructure, they empower individuals who may not have access to bank accounts or credit cards. This can lead to increased economic activity and opportunity. Mobile wallets in developing nations, for instance, have already facilitated financial transactions for millions, creating a more inclusive financial landscape.

Reducing Fraud

Digital wallets can reduce the risk of fraud compared to traditional payment methods. Secure encryption and authentication procedures are crucial components of these systems, protecting sensitive information and preventing unauthorized access. Digital wallets can also offer advanced fraud detection mechanisms, identifying suspicious transactions and notifying users promptly. This proactive approach to fraud prevention is a major advantage of digital wallets.

Digital wallets are becoming increasingly popular, and it’s no surprise. They offer convenience and security, but the innovations behind them are often driven by Fintech startups. These companies are pushing the boundaries of financial technology, and that’s leading to better digital wallet options for everyone. Fintech startups are constantly developing new features and services, which in turn improves the overall experience for users of digital wallets.

Advantages Summary

- Businesses: Increased efficiency, wider customer reach, valuable customer data, improved customer experience, reduced transaction costs.

- Consumers: Enhanced security, convenience, greater financial control, improved budgeting and tracking, reduced risk of lost or stolen cards, increased accessibility to financial services.

User Experience and Interface Design

Source: bwf.com

Digital wallets need a user-friendly interface to thrive. A well-designed interface is crucial for encouraging user adoption and fostering trust. A seamless and intuitive experience directly impacts the success of a digital wallet application. This section will explore critical design considerations for digital wallets, emphasizing user-centric design principles.

Interface Design Considerations

A successful digital wallet design prioritizes simplicity and clarity. Users should be able to navigate the application easily, find the information they need quickly, and complete transactions smoothly. Key considerations include a clean layout, intuitive navigation, and clear visual cues. Visual hierarchy is important to guide the user’s eye to the most important elements, such as transaction details or account balances.

Accessibility features are vital for inclusivity.

Intuitive and User-Friendly Interfaces

Examples of intuitive interfaces include prominently displaying the user’s balance and transaction history. Clear icons and labels are crucial for understanding the various functions. Visual cues like progress bars during transactions and confirmation messages after successful transactions can enhance the user experience. A well-designed payment process, including a simple input field for card numbers or other payment details, is crucial.

The use of familiar patterns, such as those found in other mobile banking applications, can also help. Using visual cues, like color-coding for different transaction types, helps users easily identify and categorize transactions.

Importance of Accessibility Features

Accessibility features are paramount for users with disabilities. This includes providing alternative text for images, adjustable font sizes, and support for screen readers. Color contrast should be sufficient for users with visual impairments. The interface should also be compatible with various screen sizes and devices. Designing for diverse needs ensures a wider user base can access and utilize the application.

Best Practices for a Seamless User Experience

Creating a seamless user experience involves prioritizing simplicity and clarity. Navigation should be straightforward and intuitive. Users should be able to quickly access essential functions. Clear and concise language is vital for easy understanding. Providing helpful prompts and error messages, tailored to the user, can also improve the experience.

Clear and concise language is vital for easy understanding. Providing helpful prompts and error messages, tailored to the user, can also improve the experience. Thorough testing across various devices and user groups is crucial to identify potential usability issues.

Designing for Diverse User Needs

Designing for diverse user needs means considering users with varying levels of technical expertise and familiarity with digital wallets. The interface should be easy to understand and use for novice users while offering advanced features for experienced users. Clear and concise help resources, such as a FAQ section or interactive tutorials, are essential. User feedback mechanisms should be in place to gather insights and make improvements.

Consider providing different levels of security options to cater to users with varying risk tolerance.

Mockup of a Digital Wallet Interface

| Element | Description |

|---|---|

| Navigation Bar | Clear icons for balance, transactions, settings, and more, displayed prominently at the top. |

| Account Balance | Visually prominent display of the current account balance, updated in real-time. |

| Transaction History | A list of recent transactions, with clear categorization (e.g., payments, transfers). |

| Payment Methods | Easy-to-use section to add and manage various payment methods (credit cards, debit cards, etc.). |

| Send Money | A simple form for sending money, including recipient details and amount. |

| Receive Money | A section to generate a QR code or receive money using a unique code. |

A well-designed interface fosters user trust and encourages adoption.

Technological Advancements and Future Trends

Digital wallets are rapidly evolving, driven by innovations in technology and user demand. Emerging technologies are reshaping the landscape of financial transactions, offering new opportunities for enhanced security, convenience, and efficiency. This section explores these advancements and their potential impact on the future of digital wallets.

Emerging Technologies Impacting Digital Wallets

The integration of cutting-edge technologies is transforming digital wallets. Blockchain technology, for example, is providing enhanced security and transparency by enabling secure and verifiable transactions. Biometric authentication methods, such as fingerprint scanning and facial recognition, are also becoming increasingly prevalent, adding another layer of security to digital wallet access. These advancements are leading to a more secure and user-friendly digital financial experience.

Future Potential of Digital Wallets

The future of digital wallets is brimming with potential. Beyond simple payment processing, they could become hubs for managing various financial activities, including budgeting, investing, and even accessing social benefits. The integration of AI and machine learning will play a critical role in tailoring user experiences and optimizing financial management. These developments could make digital wallets even more indispensable tools in our daily lives.

AI and Machine Learning in Digital Wallets

AI and machine learning are revolutionizing digital wallets by enabling personalized recommendations, fraud detection, and customized financial management tools. AI algorithms can analyze user spending patterns to provide personalized budgeting advice and identify potential risks, such as fraudulent transactions. Machine learning can also optimize transaction speeds and enhance security measures. These technologies are key to creating a truly intelligent and user-centric digital wallet experience.

Adapting to New Payment Methods

Digital wallets are constantly adapting to the evolution of payment methods. The integration of new technologies, such as contactless payments and mobile wallets, is ensuring compatibility with a variety of payment options. This adaptability is crucial for maintaining user convenience and ensuring a seamless transition to future payment methods.

Metaverse Technologies and Digital Wallets

The metaverse presents a fascinating opportunity for digital wallets. In a metaverse environment, digital wallets could be essential for managing virtual assets, purchasing virtual goods, and participating in virtual economies. The use of NFTs (Non-Fungible Tokens) and virtual currencies will likely necessitate secure and user-friendly digital wallet solutions tailored for these emerging virtual environments. This integration is expected to be crucial for facilitating transactions and managing assets within the metaverse.

Timeline of Digital Wallet Evolution

| Year | Milestone | Innovation |

|---|---|---|

| 2000s | Early mobile payment concepts emerge | Limited mobile phone-based payment systems |

| 2010s | Rise of mobile wallets | Apple Pay, Google Pay, and other mobile wallet services |

| 2020s | Integration of AI, Blockchain, and Biometrics | Enhanced security, personalization, and expanded functionalities |

| 2030s | Wallets as financial hubs | Comprehensive financial management, investment tools, and metaverse integration |

Regulatory Landscape and Legal Considerations

Digital wallets, while offering convenience and efficiency, operate within a complex web of regulations and legal frameworks. Navigating these rules is crucial for both users and businesses to ensure compliance and avoid potential legal issues. This section delves into the various aspects of the regulatory environment surrounding digital wallets.

Overview of Global Regulations

The landscape of digital wallet regulations is diverse and fragmented globally. Different jurisdictions have varying approaches to regulating these services, often reflecting their unique financial ecosystems and priorities. Some countries prioritize consumer protection, while others focus on preventing financial crime. This diversity can create challenges for businesses operating across borders.

Legal Frameworks Impacting Digital Wallets

Legal frameworks impacting digital wallets encompass a wide range of areas. These include consumer protection laws, anti-money laundering (AML) regulations, data privacy laws, and tax laws. Each jurisdiction may have unique laws and regulations governing aspects like KYC (Know Your Customer) procedures, transaction limits, and the handling of user data.

International Transactions and Legal Considerations

International transactions using digital wallets introduce unique legal challenges. Varying regulations in different countries can lead to complexities in compliance and dispute resolution. For instance, if a user in one country sends funds to a recipient in another country, the laws of both countries may apply, creating a need for careful consideration of the relevant regulations in each jurisdiction.

Impact of Regulations on Development and Implementation

Regulations significantly impact the development and implementation of digital wallets. Compliance requirements often necessitate substantial investment in technology and infrastructure to meet KYC/AML standards and ensure data security. Businesses must also factor in potential legal liabilities and ensure their operations adhere to the specific rules of each jurisdiction.

Responsibilities of Digital Wallet Platform Businesses

Businesses operating digital wallet platforms bear a considerable responsibility for ensuring compliance with regulations. They are often required to conduct due diligence on users, monitor transactions for suspicious activity, and safeguard user data. Failure to meet these responsibilities can lead to significant penalties and reputational damage.

Regulatory Differences Across Countries

| Country | Key Regulation |

|---|---|

| USA | A patchwork of state and federal regulations, often focusing on consumer protection and anti-money laundering. Specific regulations vary by state and service type. The Financial Crimes Enforcement Network (FinCEN) plays a significant role in setting AML standards. |

| EU | The Payment Services Directive (PSD2) and other regulations emphasize consumer protection and data privacy. The focus is on harmonization across member states. |

| China | China’s regulatory approach is often more centralized, focusing on control and oversight. Regulations emphasize national security and financial stability concerns. Specific regulations often evolve in response to market trends. |

This table provides a brief overview of the key regulatory differences. It is important to consult with legal professionals for specific advice tailored to individual circumstances. The regulatory landscape is constantly evolving, and staying informed about changes is crucial for businesses and individuals.

Integration with Other Financial Services: Digital Wallets

Digital wallets are no longer just for making quick payments. Their potential extends far beyond that, aiming to become central hubs for managing all aspects of one’s finances. This integration with other financial services is crucial for a more streamlined and convenient financial experience.Integrating digital wallets with other financial services offers a unified platform for managing various financial activities.

This includes paying bills, transferring funds, investing, and accessing other financial products. The goal is to eliminate the need to switch between multiple apps and platforms, providing a holistic financial management solution.

Integration with Payment Gateways

Payment gateways are essential for online transactions. Digital wallets can seamlessly integrate with these gateways, allowing users to make secure payments on e-commerce websites and other online platforms. This integration simplifies the checkout process and reduces the risk of fraud. The process often involves linking the digital wallet to the payment gateway account, allowing the gateway to authorize payments directly from the wallet’s funds.

This direct integration reduces friction in the payment process and often provides additional security features, such as tokenization, which protect sensitive payment information.

Integration with Banking Apps

Integrating digital wallets with banking apps is a key step in the evolution of financial technology. This integration can allow users to transfer funds between their digital wallet and bank accounts with ease. It can also enable users to check balances, pay bills, and manage transactions directly within the banking app, streamlining the overall financial management experience.

Digital wallets are becoming increasingly popular as a convenient way to manage finances. They’re a key part of the broader world of digital finance, which encompasses various innovative financial services and technologies. Exploring digital finance platforms like Digital finance reveals the potential for seamless transactions and personalized financial experiences, which digital wallets aim to deliver.

Examples of Integration

Several digital wallets are already integrating with existing financial systems. For instance, some wallets allow users to directly deposit funds from their bank accounts into the wallet, providing a fast and convenient method for replenishing wallet balances. Many digital wallets also support recurring payments, such as subscriptions or utility bills, allowing users to manage these payments directly from the wallet without the need to log into separate accounts.

Further, some wallets are designed to be fully compatible with various payment gateways, facilitating a streamlined checkout experience across a wide range of online retailers.

Process for Seamless Integration (Digital Wallet to Bank Account), Digital wallets

A seamless integration between a digital wallet and a bank account typically involves the following steps:

- Authorization: The user authenticates with their bank account using the digital wallet platform. This often involves multi-factor authentication to ensure security.

- Linking: The digital wallet platform links to the user’s bank account, allowing the wallet to access the account’s balance and transaction history. This is usually a secure process, protecting sensitive data with robust encryption protocols.

- Transaction Initiation: The user initiates a transaction, such as transferring funds from the bank account to the digital wallet. The digital wallet then securely processes the transaction with the bank.

- Confirmation: The user receives confirmation of the transaction from both the digital wallet and the bank, ensuring the transaction has been successfully completed.

This process aims to provide a frictionless experience for users, allowing them to manage their finances effectively without the need for extensive account switching.

Conclusive Thoughts

In conclusion, digital wallets are more than just a convenient way to pay; they represent a significant shift in how we interact with finance. Their security, accessibility, and integration with other financial services are crucial factors driving their adoption. As technology continues to advance, digital wallets will undoubtedly play an increasingly important role in our financial lives, shaping the future of payments and financial management.

FAQ Guide

What are the different types of digital wallets?

Different digital wallets cater to various needs and security levels. Mobile wallets are convenient for everyday use, hardware wallets offer enhanced security for storing cryptocurrency, and software wallets provide a more customizable option for managing various digital assets.

What are the security risks associated with digital wallets?

Phishing, malware, and data breaches are potential threats. Strong passwords, two-factor authentication, and regular security updates are vital for protecting your digital wallet credentials.

How do digital wallets promote financial inclusion?

Digital wallets can provide access to financial services for those who may not have traditional bank accounts, making it easier to send and receive money, pay bills, and participate in the digital economy.

How can I choose the right digital wallet for my needs?

Consider your budget, the types of transactions you make, and your preferred level of security when selecting a digital wallet. Mobile wallets are good for quick transactions, while hardware wallets are ideal for storing valuable assets like cryptocurrencies.