Banking-as-a-Service (BaaS) is changing how financial services are delivered. Imagine fintech companies and even traditional banks using a common platform to offer banking features, like payments and accounts, without building everything from scratch. It’s a game-changer, opening doors for innovation and making financial services more accessible. This new approach offers a lot of benefits for everyone involved, and it’s only going to get bigger.

This approach simplifies the process of incorporating banking features into other products and services. Think about how a ride-sharing app could integrate payments directly into its platform, or how a social media platform could offer basic savings accounts to its users. BaaS enables these types of integrations, fostering a more integrated and user-friendly financial ecosystem.

Introduction to Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) is a rapidly growing segment of the financial technology (FinTech) industry. It allows non-bank companies to integrate banking functionalities into their products and services without the need for building their own banking infrastructure. This significantly reduces the time and resources required for these companies to offer financial services, enabling faster market entry and expansion.BaaS provides a flexible and scalable approach to financial services, making it a valuable asset for businesses of all sizes.

This model offers a streamlined and efficient way to integrate various banking functionalities, fostering innovation and broadening access to financial services.

Definition and Core Functionalities

BaaS is a cloud-based platform that provides banks and other financial institutions with a suite of APIs (Application Programming Interfaces) and tools. These APIs enable third-party developers and businesses to access and utilize core banking functionalities like account management, payments, lending, and fraud prevention. This enables non-bank businesses to offer banking-related features without the substantial investments required to build and maintain these services internally.

It effectively “outsources” banking operations, allowing focus on core business.

Key Differentiators from Traditional Banking

Traditional banking models are often characterized by extensive infrastructure, high operational costs, and limited flexibility. BaaS models, in contrast, offer a modular and scalable approach, allowing businesses to tailor their offerings to specific needs and market demands. BaaS providers handle the regulatory compliance and security aspects, which are crucial aspects of traditional banking, but are often outsourced in the BaaS model.

Furthermore, BaaS is often more cost-effective and faster to implement, compared to traditional methods of offering banking services.

Types of BaaS Offerings, Banking-as-a-Service (BaaS)

The BaaS market encompasses various offerings tailored to diverse needs. These offerings often include core functionalities such as account opening, payments processing, and loan origination, among others. Specialized BaaS providers cater to particular niches, such as digital wallets or specific payment methods. Some models even offer fully integrated banking systems, encompassing the entire financial service experience. Different tiers of service exist, allowing businesses to scale their banking functionalities as needed.

Historical Overview of BaaS

The concept of BaaS emerged as a response to the increasing demand for digital financial services and the need for scalability. Early iterations focused on basic payment processing and account management. The growth of FinTech and the adoption of APIs accelerated the evolution of BaaS, providing more robust and comprehensive banking functionalities. The growing need for seamless integration of financial services across diverse platforms and applications has significantly fueled the market expansion.

Today, BaaS platforms offer extensive functionalities, enabling businesses to create complex and sophisticated financial services.

Comparison of BaaS Models

| Feature | API-Based BaaS | Platform-Based BaaS |

|---|---|---|

| Core Offering | Access to banking APIs for integration into existing systems. | A complete banking platform with pre-built functionalities. |

| Flexibility | High, allowing for customization and integration with existing systems. | Moderate, though generally more integrated and less flexible than API-based. |

| Implementation Time | Generally shorter, as integration is tailored to specific needs. | Potentially longer, as it requires adaptation to the platform’s structure. |

| Cost | Typically lower upfront, with costs tied to usage. | Potentially higher upfront, but can offer economies of scale with increased usage. |

| Control | Higher level of control over the system’s integration. | Lower level of control over the integration process. |

The table above highlights the key distinctions between API-based and platform-based BaaS models. Choosing the appropriate model depends on specific business requirements and the level of customization needed.

BaaS Architecture and Technology

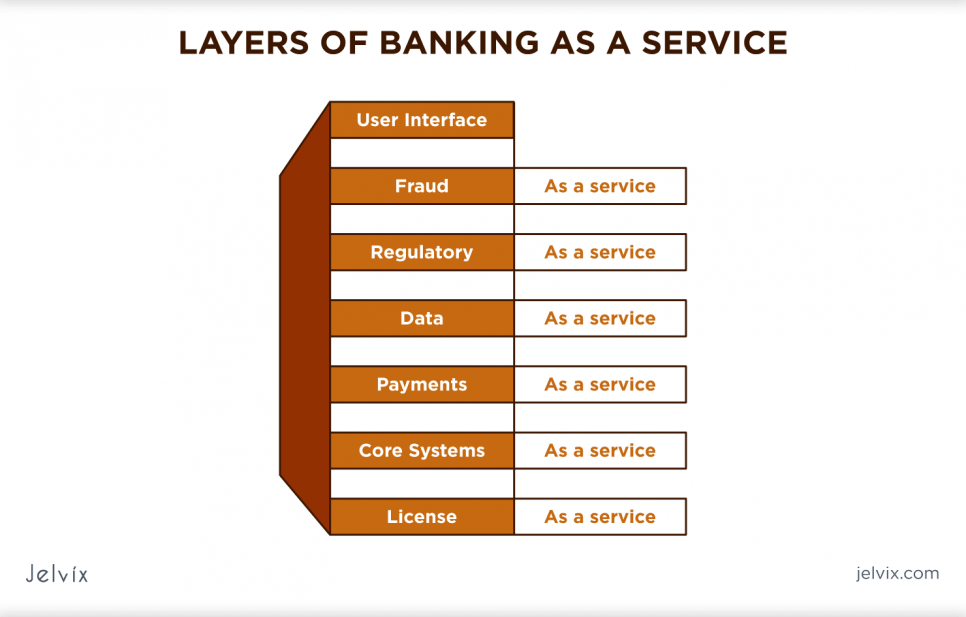

Banking-as-a-Service (BaaS) platforms leverage a sophisticated architecture to deliver banking functionalities as a service. This architecture is designed to be flexible, scalable, and secure, allowing businesses to integrate banking features without the substantial upfront investment required for building their own systems. It’s crucial to understand the building blocks of BaaS to appreciate its value proposition.The architecture of BaaS platforms is typically layered, separating different functionalities and ensuring modularity.

This allows for independent scaling and maintenance of various components. This layered approach is essential for ensuring a secure and robust system.

Technical Architecture Overview

The BaaS platform’s architecture is built upon a robust foundation of interconnected components. These components are designed to work seamlessly together, enabling a streamlined user experience and facilitating efficient transactions. Key elements of this architecture include robust APIs, secure data storage, and transaction processing capabilities.

Key Components and Interrelationships

A typical BaaS platform comprises several key components, each playing a vital role in the overall functionality. These components interact dynamically, forming a cohesive system that supports the diverse needs of various clients. These include customer onboarding and authentication, transaction processing and reconciliation, and regulatory compliance management.

- Customer Onboarding and Authentication: This component handles the initial registration and verification of users, ensuring a secure and compliant process. This is crucial for maintaining the integrity of the system and adhering to regulatory mandates. The platform typically uses advanced security protocols and biometric authentication methods to enhance user security.

- Transaction Processing and Reconciliation: This component is responsible for executing financial transactions, from fund transfers to loan applications. This component needs to be highly reliable and resilient to handle a significant volume of transactions, ensuring accurate and timely processing.

- Regulatory Compliance Management: BaaS platforms must adhere to strict regulatory requirements. This component ensures that the platform operates in accordance with all relevant laws and regulations. It’s an essential component for maintaining trust and preventing legal issues.

Crucial Technologies

Several critical technologies underpin the functionality and security of BaaS platforms. The efficient use of these technologies is crucial for scalability and performance.

- APIs (Application Programming Interfaces): APIs act as the communication channels between the BaaS platform and external applications. These APIs allow developers to easily integrate banking functionalities into their products. The efficiency of these APIs directly impacts the speed and ease of integration.

- Cloud Computing: Cloud platforms are often the foundation for BaaS, providing the necessary infrastructure for scalability and flexibility. Cloud-based solutions offer significant advantages in terms of cost-effectiveness, rapid deployment, and global reach.

Security Considerations

Security is paramount in a BaaS environment. Robust security measures are essential to protect sensitive customer data and prevent fraudulent activities. These measures include encryption, access controls, and regular security audits.

- Data Encryption: Sensitive financial data is encrypted both in transit and at rest to protect against unauthorized access.

- Access Controls: Strict access controls are implemented to restrict access to sensitive data and prevent unauthorized modifications.

- Security Audits: Regular security audits are performed to identify and address potential vulnerabilities and maintain the highest security standards.

Scalability and Performance

BaaS platforms must be designed for scalability and high performance to handle a growing number of users and transactions. Scalability is critical for long-term success, as user bases and transaction volumes can increase significantly over time.

- Load Balancing: Sophisticated load balancing mechanisms are employed to distribute incoming requests across multiple servers, ensuring optimal performance even under high load.

- Caching Mechanisms: Caching mechanisms are used to store frequently accessed data, reducing database load and improving response times.

Typical BaaS Architecture Layers

| Layer | Description |

|---|---|

| Application Layer | Handles customer interactions and integrations with external applications. |

| Service Layer | Provides core banking services, such as account management and transaction processing. |

| Data Layer | Stores and manages sensitive financial data. |

| Infrastructure Layer | Provides the underlying infrastructure, including security, networking, and cloud computing. |

Benefits and Use Cases of BaaS

Banking-as-a-Service (BaaS) is revolutionizing the financial landscape by enabling non-financial companies to integrate banking functionalities into their products and services. This allows for a broader reach and enhanced customer experiences, often with a faster time to market. It’s a powerful tool for both established financial institutions and innovative fintech startups.BaaS offers a compelling proposition by providing access to a comprehensive suite of banking services without the substantial upfront investment and operational complexities typically associated with building these capabilities internally.

This agility is particularly valuable for fintech companies looking to rapidly deploy innovative financial products and services. Furthermore, it streamlines processes for established financial institutions, allowing them to expand their reach and offerings to new markets and customer segments.

Key Advantages of BaaS for Financial Institutions and Fintech Companies

BaaS offers numerous advantages to both financial institutions and fintech companies. These advantages include cost savings, reduced development time, and enhanced scalability. Financial institutions can use BaaS to expand their reach into new markets or offer new services without the expense of building their own infrastructure. Fintech companies can quickly integrate banking services into their products without significant development costs.

Real-World Examples of BaaS Utilization

Numerous businesses are leveraging BaaS to create innovative solutions. For instance, e-commerce platforms can integrate BaaS to offer seamless payment processing, allowing customers to pay using various methods directly within their platform. Similarly, ride-sharing apps can use BaaS to provide real-time payment processing and transaction tracking for drivers and passengers. These examples highlight the diverse applications of BaaS across various industries.

Potential Risks and Challenges Associated with BaaS

While BaaS presents numerous opportunities, there are also potential risks and challenges. Security concerns are paramount, as sensitive financial data needs robust protection. Data breaches can have severe consequences for both the financial institution and the client using the BaaS platform. Regulatory compliance is another crucial aspect. Ensuring adherence to relevant financial regulations is essential for maintaining credibility and avoiding legal issues.

Furthermore, compatibility issues between different BaaS platforms can hinder integration and create complications.

How BaaS Enhances Customer Experience

BaaS can significantly enhance customer experience. By providing seamless and integrated financial services, BaaS eliminates friction in the customer journey. Customers benefit from a consistent and convenient experience across different platforms and channels, leading to increased satisfaction and loyalty. Real-time transaction processing and account management features further improve the overall customer experience.

Potential for Innovation and Disruption within the Financial Industry

BaaS fosters innovation by enabling the development of new financial products and services. Fintech companies can quickly develop innovative solutions, potentially disrupting traditional financial models. For example, BaaS enables the creation of personalized financial management tools that cater to specific customer needs. This increased competition can drive innovation and ultimately benefit consumers with better products and services.

Summary Table of BaaS Use Cases

| Industry | Use Case |

|---|---|

| E-commerce | Providing secure payment processing, enabling customers to pay directly within the platform, integrating multiple payment methods |

| Ride-sharing | Real-time payment processing for drivers and passengers, transaction tracking, and seamless payment integration |

| Fintech | Development of new financial products and services, personalized financial management tools, and innovative solutions to address specific customer needs |

| Healthcare | Streamlined billing and payment processing for medical services, integration with insurance providers, and secure patient data management |

| Travel | Payment processing for booking services, seamless integration of payment gateways, and providing secure online payment options |

BaaS Market Trends and Future Outlook

Source: jelvix.com

The Banking-as-a-Service (BaaS) market is experiencing rapid growth, driven by the increasing demand for innovative financial solutions. This sector is transforming how businesses and individuals access financial services, fostering a more inclusive and adaptable financial ecosystem. The future of BaaS promises even more significant advancements, with new trends and opportunities emerging constantly.The BaaS market is dynamic and competitive, with established players and new entrants vying for market share.

This section will explore the current market trends, predict future developments, analyze key players, and discuss the evolving competitive landscape, highlighting emerging trends such as open banking and embedded finance.

Current Market Trends

The BaaS market is currently characterized by a strong focus on ease of integration and scalability. Providers are emphasizing APIs and streamlined onboarding processes to make it simple for businesses to incorporate banking functionalities into their platforms. This focus on developer-friendliness is driving adoption, especially among fintech companies and businesses looking to expand their offerings. Additionally, there’s a noticeable increase in the adoption of cloud-based BaaS solutions for their scalability and cost-effectiveness.

Future Directions of BaaS Development

The future of BaaS is poised to integrate even more deeply with emerging technologies. This includes a growing emphasis on artificial intelligence (AI) and machine learning (ML) to enhance personalization, fraud detection, and risk assessment. Furthermore, we anticipate more sophisticated use cases, such as personalized financial advice and automated investment management tools, integrated within BaaS platforms. The rise of open banking will also continue to drive innovation, enabling seamless data exchange and the creation of more comprehensive financial services.

Major Players and Strategies

Several significant players are shaping the BaaS landscape. These companies are implementing various strategies, including strategic partnerships, acquisitions, and product development initiatives to expand their reach and capabilities. For example, some players are focusing on building comprehensive BaaS platforms, while others are specializing in specific aspects like payments or lending.

Competitive Landscape

The BaaS market is competitive, with both established financial institutions and emerging fintech companies vying for market share. The competition is marked by the variety of offerings, from basic payment processing to complex lending and investment management tools. A key differentiator is the level of integration and customization offered by each platform. This competitiveness drives innovation and the creation of increasingly sophisticated and user-friendly BaaS solutions.

Emerging Trends

Several emerging trends are shaping the BaaS market. Open banking is significantly impacting the sector, facilitating the exchange of financial data between institutions and third-party providers. Embedded finance, the integration of financial services into non-financial applications, is also a major trend, enabling businesses to offer financial products seamlessly within their existing services.

Key Players in the BaaS Market

| Company | Offering |

|---|---|

| Stripe | Comprehensive payment processing and financial services platform. |

| Fiserv | A wide range of financial services, including banking-as-a-service solutions for various businesses. |

| Plaid | Open banking platform, enabling data sharing and integration. |

| Monese | BaaS platform focusing on global financial services, with a particular emphasis on international transactions. |

Security and Compliance in BaaS

Banking-as-a-Service (BaaS) platforms are increasingly popular for their ability to offer streamlined financial services. However, security and regulatory compliance are paramount considerations for both providers and users. Robust security measures and adherence to strict regulations are crucial to building trust and ensuring the safety of sensitive financial data.Implementing secure and compliant BaaS solutions is vital for maintaining user confidence and avoiding potential financial and reputational damage.

It requires a comprehensive approach that addresses various aspects of data protection, regulatory requirements, and potential vulnerabilities.

Security Measures in BaaS Platforms

BaaS providers employ a variety of security measures to protect user data and financial transactions. These measures often involve multi-layered security protocols, encryption techniques, and robust access controls. Data encryption at rest and in transit is a critical element, safeguarding sensitive information from unauthorized access.

- Authentication and Authorization: Strong authentication mechanisms, such as multi-factor authentication (MFA), are employed to verify user identities and restrict access to sensitive data based on predefined roles and permissions. This prevents unauthorized individuals from gaining access to accounts or sensitive information.

- Data Encryption: Data encryption plays a crucial role in protecting sensitive information both during transmission (in transit) and when stored (at rest). Advanced encryption algorithms are used to ensure that only authorized users can access the data.

- Regular Security Audits and Penetration Testing: Regular security audits and penetration testing are essential to identify vulnerabilities and weaknesses in the BaaS platform. This proactive approach helps in strengthening security defenses and mitigating potential risks.

- Access Control and Monitoring: Strict access controls and continuous monitoring of system activity are implemented to detect and respond to security incidents promptly. Real-time monitoring of transactions and user activity allows for quick identification and resolution of potential issues.

Regulatory Compliance Requirements for BaaS Providers

BaaS providers must adhere to stringent regulatory compliance requirements, which vary based on the jurisdiction and type of financial services offered. Compliance with these regulations ensures that the platform meets the highest standards of security and financial integrity. These regulations often cover data privacy, security, and transaction processing.

- Data Privacy Regulations: Compliance with data privacy regulations, such as GDPR in Europe or CCPA in California, is essential for BaaS providers. This includes ensuring that data is collected, used, and stored in compliance with the specific regulations.

- Anti-Money Laundering (AML) and Know Your Customer (KYC) Regulations: BaaS providers are often required to comply with AML and KYC regulations to prevent financial crimes. Implementing robust measures to verify customer identities and monitor transactions is essential to meet these requirements.

- Payment Card Industry Data Security Standard (PCI DSS): If the BaaS platform processes credit card information, compliance with PCI DSS is mandatory. This standard Artikels specific security requirements for handling and protecting payment card data.

Data Security and Privacy in BaaS

Data security and privacy are critical aspects of BaaS. Providers must implement robust security measures to protect sensitive customer data from unauthorized access, use, or disclosure. This includes measures to protect against data breaches, ensuring compliance with data privacy regulations, and maintaining the confidentiality and integrity of user information.

- Data Breach Prevention: Proactive measures to prevent data breaches, such as implementing strong security protocols and regularly updating systems, are essential to safeguarding user data.

- Data Loss Prevention (DLP): Implementing DLP mechanisms to prevent sensitive data from leaving the platform or being inappropriately accessed by unauthorized personnel is crucial.

- Data Subject Rights: BaaS providers must ensure compliance with data subject rights, allowing users to access, correct, or delete their data as per applicable regulations.

Comparison of Security Protocols and Best Practices

Different security protocols and best practices are employed by BaaS providers. These protocols include encryption, multi-factor authentication, and access control lists. Security measures should be tailored to the specific needs and risks of the BaaS platform.

- Encryption Techniques: Advanced encryption standards, such as AES-256, are used to protect sensitive data. Encryption is critical for securing data both in transit and at rest.

- Multi-Factor Authentication (MFA): MFA adds an extra layer of security, requiring users to provide multiple forms of verification to access accounts. This enhances the security posture.

- Security Information and Event Management (SIEM): SIEM systems collect and analyze security logs to identify potential threats and security incidents.

Potential Vulnerabilities and Mitigation Strategies

Potential vulnerabilities in BaaS platforms can arise from various sources, such as software flaws, human error, or external attacks. Mitigation strategies should address these vulnerabilities proactively.

- Vulnerable APIs: Vulnerabilities in APIs can expose sensitive data or allow unauthorized access. Regular security assessments and updates to APIs are crucial to mitigate these risks.

- Social Engineering Attacks: Phishing and other social engineering attacks can compromise user credentials or gain unauthorized access to systems. Employee training and awareness programs are important in mitigating these risks.

- Third-Party Dependencies: Dependencies on third-party services or components can introduce security vulnerabilities. Careful vetting and monitoring of third-party integrations are crucial.

Security Measures Table

| Security Measure | Description | Example |

|---|---|---|

| Authentication | Verifying user identity | Multi-factor authentication (MFA) |

| Authorization | Controlling access to resources | Role-based access control (RBAC) |

| Encryption | Protecting data confidentiality | AES-256 encryption |

| Auditing | Tracking system activity | Security information and event management (SIEM) |

BaaS and Open Banking: Banking-as-a-Service (BaaS)

Banking-as-a-Service (BaaS) platforms are rapidly evolving, and open banking initiatives are significantly impacting their landscape. This integration unlocks new possibilities for financial institutions and fintech companies alike, fostering innovation and enhanced customer experiences.Open banking leverages APIs to allow third-party providers access to customer financial data, thereby fostering competition and creating new financial products and services. BaaS platforms provide the infrastructure and tools to facilitate this access, streamlining the process and enabling seamless integration.

Connection Between BaaS and Open Banking

BaaS platforms are inherently well-suited for supporting open banking. They offer standardized APIs and secure data management capabilities, enabling seamless integration with open banking APIs. This reduces the complexity and cost associated with building and maintaining such integrations, allowing businesses to focus on their core competencies.

Impact of Open Banking on the BaaS Landscape

Open banking significantly expands the capabilities of BaaS platforms. It allows for the creation of new financial products and services by providing access to customer financial data. This access can enable the development of personalized financial management tools, automated payments, and more sophisticated financial insights.

Examples of BaaS Platform Facilitating Open Banking Transactions

Many BaaS providers are actively integrating open banking APIs into their platforms. For example, a BaaS platform could enable a fintech company to build a budgeting app that pulls transaction data from customer bank accounts via open banking APIs. Another example could be a BaaS-powered platform that allows users to easily transfer funds between different accounts using open banking connections.

Comparison of Open Banking Models and Their Integration with BaaS

Different open banking models exist, each with its own set of requirements and specifications. For instance, the PSD2 directive (Payment Services Directive 2) in Europe defines the framework for open banking. BaaS platforms can accommodate these variations by providing flexible API integrations and adapting to evolving standards.

Overview of Open Banking Enhancing the BaaS Experience

Open banking enhances the BaaS experience by allowing for the creation of more sophisticated and personalized financial services. By providing access to customer financial data, BaaS platforms can offer products that are tailored to individual needs, leading to greater customer satisfaction and loyalty. The insights gleaned from this data can also drive innovation within the BaaS ecosystem.

Integration Points Between Open Banking and BaaS

| Integration Point | Description |

|---|---|

| API Access | BaaS platforms provide secure access to open banking APIs, allowing third-party applications to retrieve customer financial data. |

| Data Security | BaaS platforms must adhere to strict security standards and regulations (e.g., GDPR) to protect customer data during open banking transactions. |

| Data Transformation | BaaS platforms often handle the transformation of data from various open banking formats into a consistent format, simplifying integration with internal systems. |

| Regulatory Compliance | BaaS platforms must ensure compliance with open banking regulations and standards to operate legally and securely. |

| User Experience | BaaS platforms can integrate user interfaces and workflows to provide a smooth and intuitive experience for customers using open banking-enabled services. |

BaaS and Embedded Finance

Embedded finance is the seamless integration of financial services into non-financial products and platforms. This integration often leverages Banking-as-a-Service (BaaS) to provide a smooth and efficient way to incorporate financial functionalities. This approach is transforming how consumers interact with businesses, providing new opportunities for innovation and growth.

Relationship Between BaaS and Embedded Finance

BaaS platforms act as a foundation for embedded finance. They provide the necessary infrastructure, APIs, and security to allow businesses to integrate financial products like payments, lending, or insurance into their existing applications without having to build and maintain the entire financial infrastructure themselves. This significantly reduces the complexity and cost of development, allowing businesses to focus on their core competencies.

Examples of Embedded Finance Applications Powered by BaaS

Several companies are leveraging BaaS to create innovative embedded finance applications. For instance, a travel app might integrate BaaS to offer travel insurance or in-app payment options. A social media platform could use BaaS to facilitate peer-to-peer payments or micro-loans for users. These are just a few examples, demonstrating the vast potential of embedded finance to enhance customer experience and create new revenue streams.

Benefits of Embedding Financial Services

Integrating financial services into non-financial platforms yields several advantages. First, it enhances user experience by providing convenient and integrated financial options. Secondly, it fosters customer loyalty by offering relevant and tailored financial services directly within their existing ecosystem. Thirdly, it opens up new revenue streams by offering additional value-added financial products.

Challenges Associated with Embedded Finance using BaaS

While embedded finance offers significant advantages, challenges remain. Maintaining security and compliance with regulatory requirements is crucial. Ensuring seamless integration with existing systems and maintaining a positive user experience are also important considerations. Additionally, the integration of different financial products can be complex and requires careful planning and execution.

Creating Innovative Financial Products with BaaS

BaaS enables the creation of innovative financial products by facilitating rapid prototyping and deployment. This allows for experimentation with new financial products and services, potentially leading to innovative solutions that address specific market needs. For instance, a retailer might utilize BaaS to offer personalized financing options to customers or develop unique savings programs.

Table of Embedded Finance Applications and BaaS

| Application | Financial Service | Use of BaaS |

|---|---|---|

| E-commerce platform | Installment payments, Buy Now Pay Later (BNPL) | Integration of payment processing and financing options |

| Healthcare app | Virtual healthcare payments, insurance claim processing | Streamlined payment gateways and secure data transfer |

| Real estate platform | Mortgage pre-qualification, property financing | Integration of credit checks and lending options |

| Gaming platform | In-game purchases, virtual currency management | Facilitating secure transactions and managing virtual assets |

Last Point

In conclusion, Banking-as-a-Service (BaaS) presents a compelling opportunity for financial institutions and fintech companies alike. By leveraging the power of APIs and cloud-based platforms, BaaS fosters innovation, improves customer experience, and expands access to financial services. However, security and compliance remain critical concerns that need careful consideration. The future of BaaS looks bright, and its potential to revolutionize the financial industry is undeniable.

Key Questions Answered

What are the typical security measures used in BaaS platforms?

BaaS platforms employ various security measures, including multi-factor authentication, encryption, and regular security audits. They also often adhere to industry-standard security protocols to protect sensitive financial data.

How does BaaS differ from traditional banking?

Traditional banking often involves complex in-house systems. BaaS, on the other hand, leverages APIs and cloud-based platforms, allowing for faster development and easier integration of financial services into other applications.

What are some common use cases for BaaS?

Common use cases include embedded finance in apps, offering payment processing to non-financial companies, and enabling account management features for various platforms.

What are the main challenges associated with BaaS?

While BaaS offers many benefits, challenges like regulatory compliance, security vulnerabilities, and ensuring seamless integration with existing systems need careful attention.